Income Tax

Income Tax — a tax on personal earnings for individuals, income tax rate in Singapore is progressive starting at 0%. The maximum is 22% for yearly income over S$320,000. Foreigners pay the same tax on the income earned in Singapore. East river does accounting for companies in Singapore, but we can help with personal tax filings, too. Just saying.

Who pays Singapore income tax?

You have to pay Singapore income tax if you are a resident:

- a Singaporean

- a Permanent Resident that has settled in the country

- a foreigner who has spent 183 days in Singapore or more in the tax year The employment income of non-residents (i.e. individuals who spent less than 183 days in the country) will be taxes as follows:

- exempted from tax if you spent 60 days or less working. This does not apply to company directors, public entertainers, or professionals such as coaches, foreign speakers, consultants, etc.

- at 15% or the regular progressive rate (whichever is higher) if you spend 61-182 days in Singapore

- 15%-22% on director fees and consultant fees

What is the income tax rate in Singapore?

| Chargeable income (S$) | Estimated tax (S$) | Effective tax rate |

|---|---|---|

| first 20,000 | 0 | 0% |

| next 10,000 | 200 | 2.0% |

| next 10,000 | 350 | 3.5% |

| next 40,000 | 2,800 | 7.0% |

| next 40,000 | 4,600 | 11.5% |

| next 40,000 | 6,000 | 15.0% |

| next 40,000 | 7,200 | 18.0% |

| next 40,000 | 7,600 | 19.0% |

| next 40,000 | 7,800 | 19.5% |

| next 40,000 | 8,000 | 20.0% |

| over 320,000 | 44,550 | 22.0% |

How is income tax calculated?

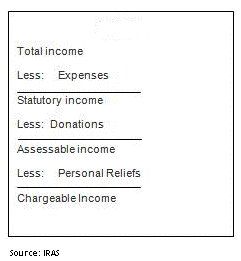

You are taxed on the chargeable income, meaning: your total income – qualifies expenses – donations – personal reliefs.

- Your total income is anything you gain as a sole proprietr, partner in a partnership, or employed professional, dividends, interest, investment and rental income. It does not include qualified income earned overseas

- You can deduct expenses like qualified employment or rental related expenses

- You can deduct donations that you made to qualified charitable organizations

- You can deduct personal reliefs such as certain course fees, parent relief, etc.

Personal tax for Singapore residents

You are considered a tax resident in the following cases:

- You are a Singaporean

- You are a Singapore Permanent Resident and have established your permanent home in Singapore

- You are a foreigner who has stayed or worked in Singapore for 183 days or more in the tax year

Tax residents pay taxes on their chargeable income.