Save up to S$1,080 on Accounting with Start Digital

Get one year covered on online accounting, automated bookkeeping, proactive tax support and HR or e-commerce software solutions for your business

One accounting bundle for OCBC Business Account

Software solution for your business

Single package covers accounting, tax, bookkeeping, and your choice of HR or e-commerce platform subscription

Personal Accountant who has your back

A Chartered Accountant assigned to your company will track filing deadlines, suggest tax exemptions, and prepare reports. Whatever your case is, someone who’s handled it before will share the expertise.

Painless accounting and bookkeeping

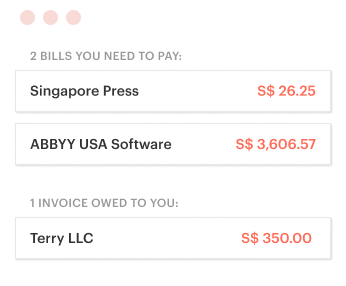

We’ll take over your invoices, receipts, and bank statements in any format. We then sort, match them, and prepare reports, all with correct tax categories.

Let’s make sure you qualify

30% of your

company or more belongs to Singaporeans or PRsStart Digital Pack is created by Singapore government to support local business. If your company is foreign-owned, check out our Accounting packages

You are an OCBC client — or want to become one

We collaborated with OCBC Bank to provide Start Digital special. If you’re not a client yet, you can open an OCBC Business Account in one day* — just let us know

It’s your first time getting Start Digital Pack, Xero and Talenox/Shopify

Start Digital targets new companies and helps them digitise their process. If it’s not your case, check out our Accounting packages

Choose the plan that works for your business

Need more?

Additional services you may need

Get more- Multicurrency accounting S$200/y

- Consolidated Unaudited report S$1,000

- Payroll, per person S$25/m

- GST registration S$300

- GST preparation and filing fee S$300/q

- Unaudited Financial Statements S$800

Our clients know best

89% of customers recommend us

7,500+ clients worldwide

Here’s what our customers say

Q&A

What is SMEs Go Digital programme in Singapore?

SMEs Go Digital is a programme that supports Singapore small and medium businesses. It has been developed by Infocomm Media Development Authority (IMDA). The government helps businesses become more digital, including covering expenses, helping promote digital services, and building a digital community.

What are Start Digital packages by OCBC Bank?

OCBC is one of the key partners chosen by IMDA to deliver Start Digital Pack to Singapore SMEs. This programme supports digitising business needs, such as bookkeeping, payroll, and admin services. Within Start Digital, SMEs can get software solutions from Xero, Talenox and Shopify with a discount or free.

How does your accounting pricing work?

We build packages based on your company's revenue, not the number of transactions.

The Starter-Start Digital plan is based on a revenue achievement of up to $120k per 12 month Financial Year. You can upgrade to a larger package as your company grows.

In what form should I submit my data?

Send us your records in whichever format you have them. Snap pictures with your phone, forward emails, or drag and drop files on your desktop — we’ll take them, tag and organise, and store neatly forever.

Can I switch to Xero from Quickbooks or Sage?

Transferring to Xero is easy and free. You'll need to download a CSV file containing your data from the current provider and send it to us. We'll take care of the rest: upload it into Xero and set up your new account.

What if I need more than 5 employees in Talenox?

Start Digital includes Talenox Suite, which fully covers 5 employees. If you need more, you can add as many as you need at Talenox rates. Right now they stand at + $8 for each additional active full-time employee and + $4 for each additional active part-time employee, with a total monthly cap of $400.

What is included in the Shopify package?

The e-commerce package includes 6 months of Basic Shopify subscription with an unlimited number of products, up to 70 payment gateways, user-friendly Store Management, and 24/7 support.

Does Shopify do accounting?

Shopify doesn’t provide accounting, so you’ll need someone else to do it. It doesn’t have to be you (in fact, it’s probably best that it isn’t). We can help you with Shopify accounting services that won’t require much of your time and cost reasonably.

The most important thing about Shopify dropshipping accounting (or any other type of Shopify business you’re in) is that every transaction is accounted for. A transaction is whenever money or assets go in or out. Every transaction should be tagged with a relevant tax rate and matched to statements from your banks. The next step is preparing reports. Some serve as tools to increase your performance: P&L, profitability, etc. Others have to be prepared and filed as per the government’s request: Estimated Chargeable Income, Tax returns.

We upload Shopify sales, use A2X and Xero to convert them into books, and then develop reports. We submit government filings neatly and on time, so no nasty fines there.