PAYE & Tax Reference Numbers: Don’t Let These Codes Confuse You

Your company has several numbers that go on official documents. As the business has different obligations, they are dealt with by different HMRC departments. To identify your company, they all attribute codes to you.

For a person who doesn't deal with neither accounting nor bookkeeping every day, the names and the purposes of these codes are quite confusing. So let’s quickly sort them out. And don't forget that you can always trust your bookkeeping or accounting online services to us.

Unique Taxpayer Reference (UTR)

Save The Dates for Annual Filing Requirements

After setting up a Limited Company forms and payments to file, all with different deadlines.

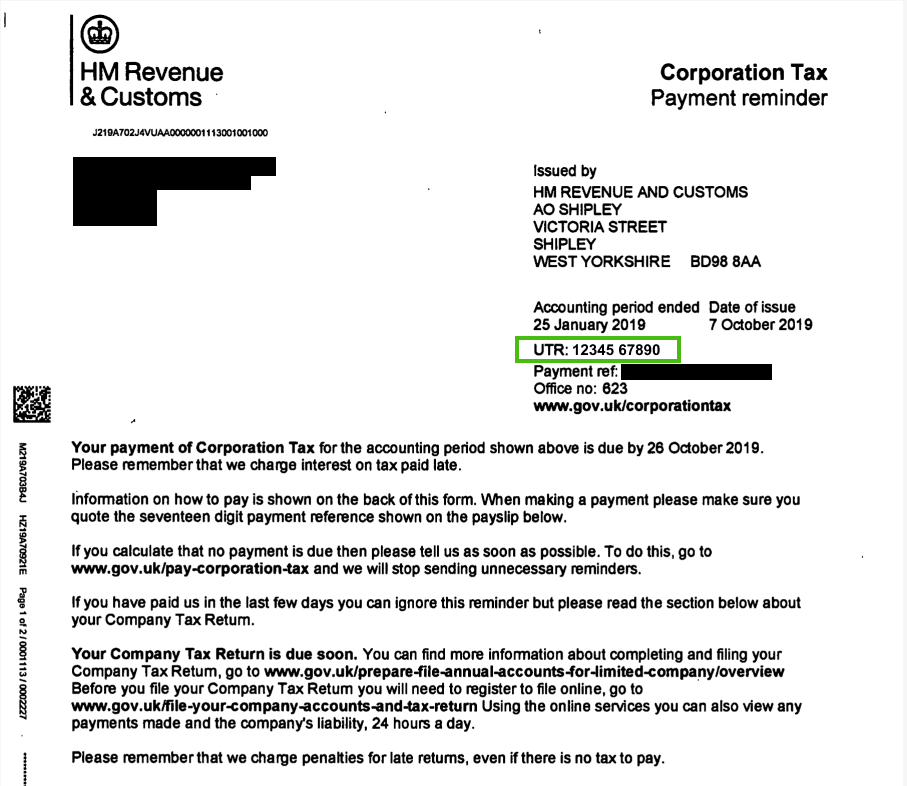

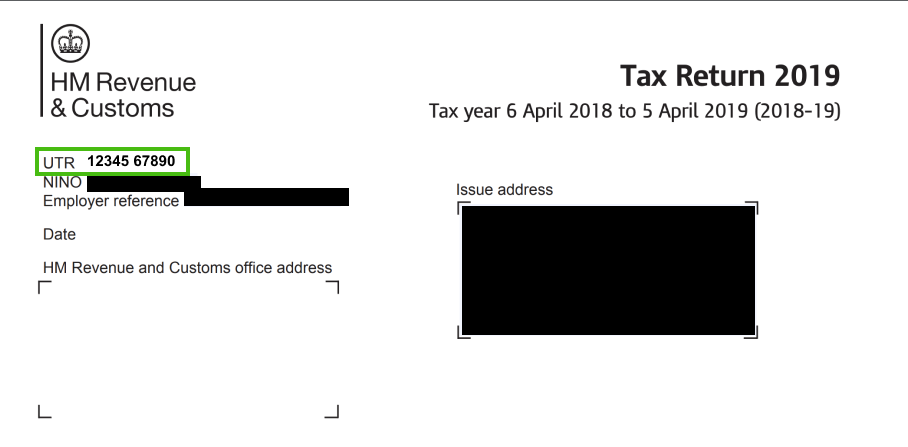

Unique Tax Reference (UTR) is a 10-digit number provided by HMRC when a person registers for self-assessment or sets up a Limited Company. You will need your company UTR number when submitting the Company Tax Return.

HMRC also issues UTRs for individuals. They are called the same and are both 10 digits long, but your company’s UTR and your own one are different. Self-employed people, sole traders and business owners use their Unique Taxpayer References to submit their tax returns to HMRC. A Unique Taxpayer Reference number goes on self-assessment forms.

Employer PAYE Reference Number & where to find it

Oops. You’ve overpaid an Employee?

We all make mistakes. Here’s what to do in case that happens.

An employer PAYE reference number is given to every business that hires people and has set up the Pay-As-You-Earn (PAYE) scheme.

Mind that not every employer that has employees needs to deal with PAYE — although every employer must keep the payroll records in order.

When doesn’t a company need PAYE? When none of its employers earns more than £118 a week and there are no expenses and benefits. Also, none of the employees must have either another job or a pension.

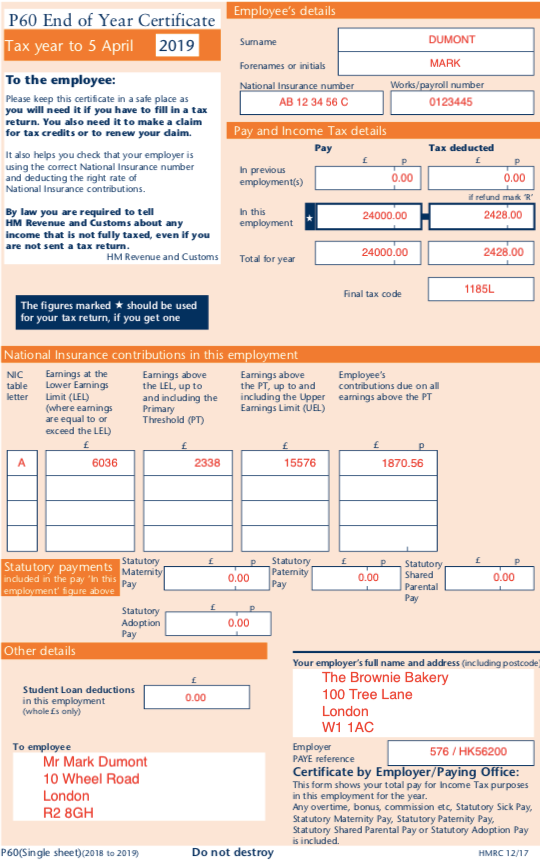

If any PAYE-registered entity employs staff, the PAYE reference number is something it cannot do without. It goes on all payroll (PAYE) papers handed out to employees and submitted to HMRC. So it can be found on payslips and Forms like P45 and P11D.

So how to find the employer's PAYE reference number? An obvious place to check is a P60 form — a notice about an employee’s gross pay, tax paid, contributions to National Insurance, etc. An employer is obliged to prepare and hand out P60 forms every April. If you are looking for a reference number at your P60, here it is:

As this number identifies the employer, not the employee, a person can have different Employer PAYE Reference Numbers on papers from different employers.

Ann works in a bookshop on weekdays and in a cafe on weekends. So she receives 2 sets of the payslips and payroll papers that contain different PAYE reference numbers — one for the cafe, the other one for the bookshop.

Tax Code

This one also goes on payslips but has a different purpose. Tax code is used by the employers and pension providers to calculate how much Income Tax a certain person must pay.

Different tax rates are applied to different employees. There are tax brackets and earnings thresholds that determine how much tax a certain person is to pay. Also, there are deductions one might be eligible for. It is the employer’s responsibility to keep track of all that and pay Income tax on behalf of their workers. The tax code determines how tax should be deducted in a pay period.

Account Office Reference Number

This one is issued by HMRC at the same time as they issue Employer PAYE Reference number. Account Office Reference Number is a 13-digit number required when paying to HMRC the PAYE liabilities. Any documents given to employees do not contain this number.

VAT Registration Number

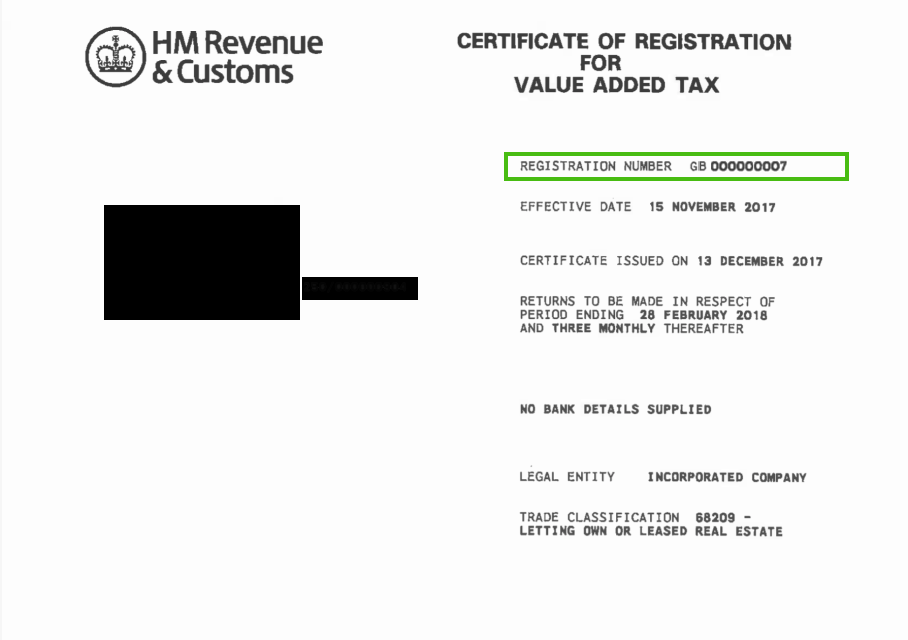

As you can guess from the title, the VAT number is issued by HMRC for businesses when they register for Value Added Tax. This number can be found in all the submitted VAT reports and on VAT certificates.

A Note on VAT Returns

VAT payment due dates might be every month, every quarter (3 months), or every year — you get to choose how long your accounting period will be.

In short, it goes on any correspondence from HMRC in relation to VAT. Also, you are obliged to show the VAT registration number on any VAT invoice you issue for your customers, including the simplified ones.

East river knows not only how to guide you through accounting and bookkeeping. We can help you open your company in the UK.