VAT Returns and Making Tax Digital (MTD) in the UK

Filing your VAT return and paying the tax is part of your accounting obligations to the UK authorities. From 2019, VAT goes hand in hand with Making Tax Digital — a compulsory system, moving the VAT payments online.

MTD is a system that makes things a lot easier for those who chose to outsource their bookkeeping and accounting services to an online firm.

We explain what it is all about and what deadlines there are not to miss.

What is VAT?

VAT stands for “Value Added Tax”, that is a tax on the sale of goods and services. A business must pay VAT if its VAT taxable turnover exceeds a certain limit. The most frequent threshold is £85,000 but it may be different if you are an overseas business importing into the UK or you trade with the EU.

The VAT tax rate is the amount of VAT charged depending on the types of goods and services in question. It varies, but 20% is a standard one.

What are the VAT deadlines?

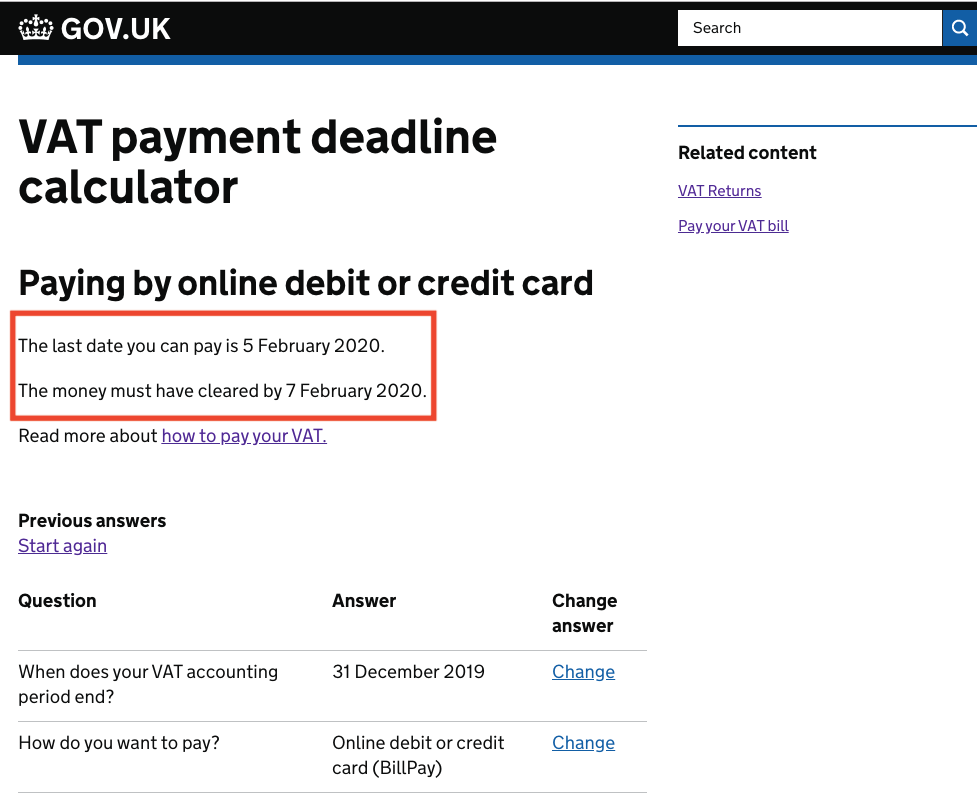

VAT payment due dates might be every month, every quarter (3 months), or every year — you get to choose how long your accounting period will be.

If you submit the return yearly, you still pay your VAT more than once a year and the sum is based on estimations — this scheme is the least popular of all.

VAT return due dates:

| Monthly | 1 calendar month and 7 days after the reported month ends |

| Quarterly | 1 calendar month and 7 days after the reported quarter ends |

For 1 or 3 months, you must submit the returns and pay tax within 1 calendar month and 7 days after the accounting period ends. If your money does not make it to HMRC within the set time frame, they will assume you broke the deadline and fine you. Of course, it is important not to miss the VAT return deadlines, but it is also better to pay your taxes in advance.

Richards’ quarter-long accounting period ends on 31 March 2020. He must submit and pay VAT to HMRC by 7 May 2020.

His competitor Jannie pays VAT monthly. She is to pay the bill for March 2020 and one of her deadlines is also 7 May 2020.

What is MTD?

MTD stands for Making Tax Digital — what is a compulsory system of online tax filing, that is to be fully introduced by 2020-2021.

You can use the government’s accounting software or just keep using the software you already have — if it has made its way to the list of HMRC-approved services. For example, Xero and Moneysoft have.

Most businesses in the UK are obliged to switch to digital VAT records from the 1st April of 2019. When the authorities launched the service, they set MTD deadlines:

| Type of business | Deadline for switching to MTD |

|---|---|

| Most of the cases (it is you unless you are notified that you are in the deferral group) | 1 April 2019 |

| Deferral group businesses (for which it is thought harder to switch): non-profit organisations that are not companies, trusts, traders based overseas, etc. | 1 October 2019 |

You can apply for an exemption from using MTD by calling or writing to HMRC. They might grant you the exemption if you can’t use computers/internet because of your age, disability or location, or if you object to using MTD on religious grounds. HMRC will make a decision on a case-by-case basis.

As for the penalties, HMRC stated that the first year of MTD usage is a soft landing period, what would mean that they might not be too strict if you fail to comply with the compulsory initiative’s guidelines. However, you will still get penalties for failing to submit VAT in time.

So far, MTD has been put into full practice and made compulsory only for VAT filings. However, MTD for income tax and corporation tax are also on their way — but they are not expected to become fully operational before 2021. HMRC is also working on MTD for individual tax returns.

Starting a new business in the UK? We will do all the work for you.