7 Best Ways To Accept Payments For Your Online Store

As an e-commerce merchant, many payment options allow you to accept credit cards and other types of payments online. But how do you choose which online payment processing method to include on your website? Read on.

When you’re growing your e-commerce business there are so many factors that you can experiment with to increase your sales. You wouldn’t want to spend any of your time on boring and routine paperwork like accounting. That’s when you can turn to our e-commerce accountants. Drop us a line to find out more, otherwise, do read on!

How To Choose an Online Payment Processing Method That’s Best For Your Business?

Payment gateways or merchant accounts are the ones that offer online payment processing solutions.

A payment gateway is the technology behind processing payments online, acting as the middleman between the buyer and seller. Payment gateways encrypt sensitive card details, ensures the funds are available in the customer’s bank, and allows the merchants to get paid. Examples of payment gateways in the United Kingdom include WorldPay, Amazon Pay, and Stripe.

A merchant account, on the other hand, is set up by banks offering online payment processing solutions. They help you accept credit card payments from your customers. Many merchant accounts are also payment gateways. In the U.K., banks like Barclaycard and Lloyds Cardnet bank offer merchant accounts to online sellers.

Before we go on to list all the available payments options online for you as an e-commerce seller, these are some tips to consider when choosing payment gateways and merchant accounts:

- Be wary of tiered pricing. Some payment gateways charge different rates and fees for different card types. Tiered pricing is usually the most expensive and ambiguous option for online sellers or merchants.

- Confirm the monthly fee rate. While you might be sold on the low per transaction fee, the payment gateway or merchant account’s monthly fees might be high.

- Figure in setup time and fees. There is an approval process if you opt for a traditional merchant account which takes a longer time as compared to other payment gateways, especially when you are a new business owner.

- Read the fine print. Some payment solution service providers include in their requirements or contracts that you must engage them for at least a year, others have minimum monthly transactions for you to meet.

- Verify compatibility. Confirm that the service providers’ plugins, software, etc. are compatible with your own website or online store’s.

7 Ways To Accept Payment For Your E-commerce in 2021

-

Debit, Credit and Prepaid Cards

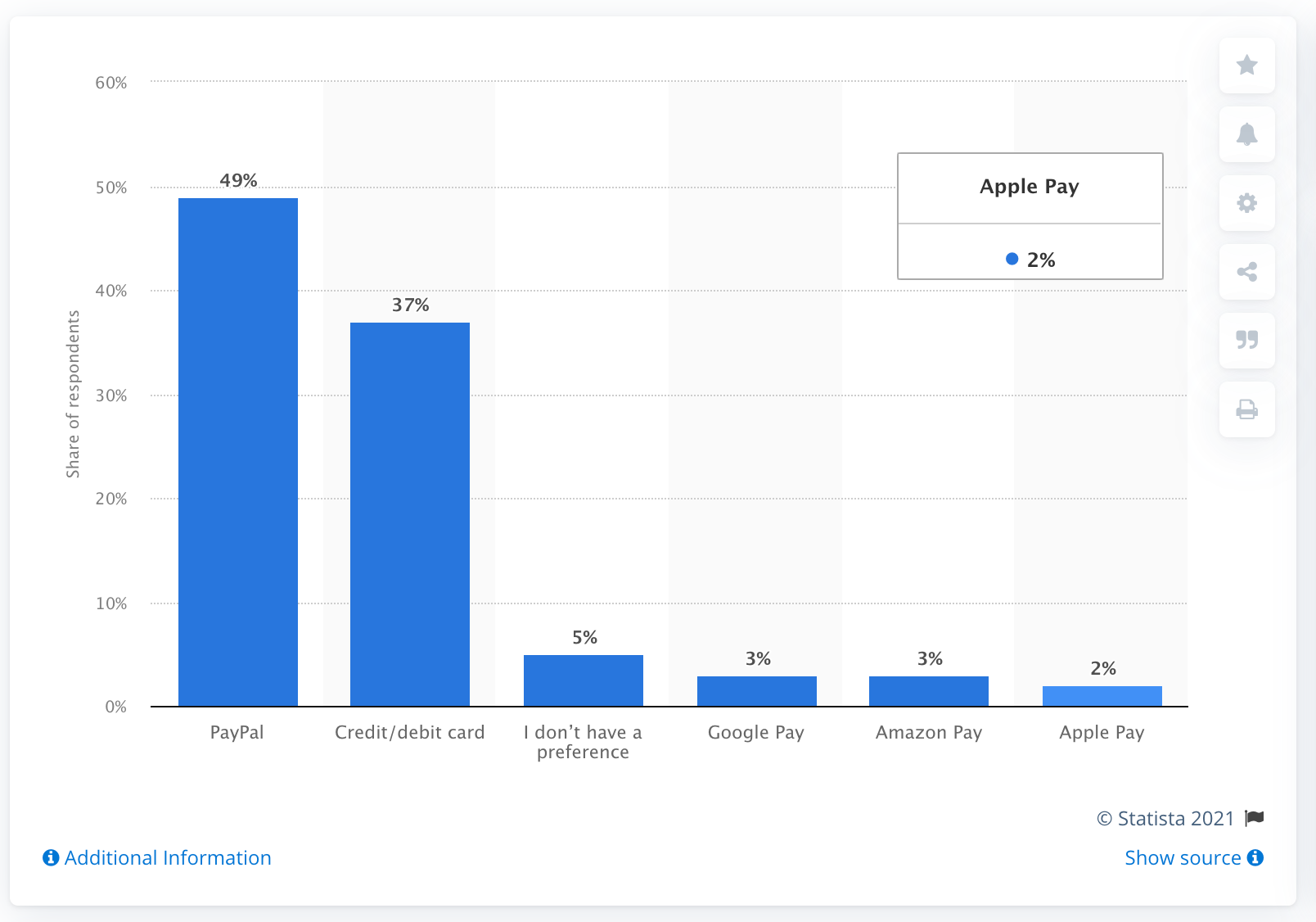

In a 2019 survey carried out by Attest, 37% of online shoppers used credit or debit cards for their online purchases, the second most popular payment method after PayPal. Accepting debit and credit cards would mean that you capture more than a third of British online shoppers, thus it is prudent that you keep that option open for them on your mobile store.

| Pros Of Accepting Card Payments | Cons Of Accepting Card Payments |

|---|---|

|

1. Everyone has one. Nowadays more people pay by card rather than cash, and online payment gateways have made it easy for merchants to accept credit and debit card payments. 2. Speed and convenience for customers. Credit and debit card payments are processed quickly, especially if an online shopper has saved his card information on a website. 3. Access to more customers. Card payments give you a competitive edge. Accepting credit cards like Visa and Mastercard for example, gives you access to international buyers too. |

1. More costs. For an online seller, the fees of accepting card payments add up quite high. Most payment gateways charge setup fees, transaction and processing fees, and monthly fees. 2. Extra bookkeeping. You need to keep track of your paying your merchant account or payment gateways monthly or yearly, and keep a record of all your transactions and invoices. For this, you can outsource your bookkeeping tasks to service providers like East river. Drop us a chat to find out more! 3. Security and fraud risk. As payment gateways operate over the internet, there is the ever-present risk of breach of card details, however minimal. Physical cards might also be lost or stolen. 4. Chargebacks. You may be charged a chargeback fee when a customer disputes a purchase and your card processor issues a refund for him. |

Top Credit And Debit Cards Used In The United Kingdom

- Visa

In 2019, Visa processed USD $8.8 trillion in payments volume and generated USD $23 billion in total revenue. As of 2018, it has 3.3 billion cards in circulation worldwide. It is widely accepted both in brick-and-mortar and online stores in the U.K.

- MasterCard

In 2019, MasterCard had a payment volume of USD $6.5 trillion and its total revenue was USD $16.9 billion. As of 2020, there are 2.3 billion MasterCards in circulation globally. While Visa surpasses MasterCard in terms of transactions, purchase volume and cards in circulation, both are almost always accepted together among merchants internationally.

Both Visa and MasterCard mainly earn from service and data processing fees. However, they classify these fees differently and have distinct fee structures. Service fees are based on card volume and charged to the issuing bank. For data processing fees, Visa and MasterCard also charge them to the issuer, who pass them on to merchants who collect a per-transaction fee. They are the fees charged for the sharing of transactional information over Visa and MasterCard’s networks with merchants.

Some of the popular banks in the U.K. and the bank accounts that issue debit cards in the U.K. are the Santander Everyday Current Account, Starling Bank Current Account, Barclays Bank Account, Royal Bank of Scotland Select Account, Natwest Select Account, and First Direct 1st Account.

Prepaid Cards

Prepaid cards, cash cards, prepaid credit (they don’t offer credit though) cards, prepaid debit cards all mean the same thing. They are all reloadable money cards that you would top-up, much like pay-as-you-go mobile phone plans. They are usually for people who are budgeting or learning to budget, e.g. those with bad credit scores, students, and children.

Prepaid cards charge monthly fees of about £2 to £5 and also transaction and ATM withdrawals fees around £2 each time. Prepaid cards could be used both in-store, and for online payments. However, booking a hotel, or flight, or hiring a car would usually not be accepted by using a prepaid card. Examples of prepaid cards are thinkmoney Prepaid Card, Cashplus plus prepaid MasterCard (Deluxe), Pockit Prepaid Card, Rooster Money Prepaid Card for Parents and Kids, and Suits Me Premium Card.

-

Digital and Mobile Wallets

A mobile, digital or e-wallet is a virtual wallet where users store, send, and receive money and pay for purchases made online. More than two-thirds of UK adults (72%) used online banking and more than half (54%) used mobile banking in 2020, UK Finance found. The ones popular in the United Kingdom include PayPal, Google Pay, Apple Pay, and Samsung Pay.

| Pros Of Accepting Digital Wallets For Online Merchants | Cons Of Accepting Digital Wallets For Online Merchants |

|---|---|

|

1. Smooth payment process. Digital or mobile wallets reduce friction and cart abandonment and increase conversion rates among your customers as their payment details are already stored in their wallets. It is usually a one-click payment button without additional forms and verifications to fill up. 2. Security for merchants and consumers. Access to digital wallets are linked to users’ devices, which are locked by facial IDs, thumbprints and security codes. Merchants and consumers alike trust digital wallets providers as they provide support and resolution for purchase disputes or conflicts. 3. Responding to customers’ preferences.Customers are increasingly adopting mobile and e-wallets use. |

1. A high degree of localization. There are many e-wallets currently in the world. Merchants need to accept the e-wallet most used by their target market. 2. Multiple integrations. Integrating new systems of payment within an existing website or store systems might be challenging and time-consuming for a merchant. Merchants could consider service providers like Stripe who have all-in-one API solutions that integrate with many different mobile and digital wallets. 3. Service downtimes. Online payment services and digital wallets might face in-app technical glitches or network delays, resulting in downtime for users. |

Top Digital And Mobile Wallets Used In The United Kingdom

- PayPal. PayPal is the top digital wallet in the United Kingdom because it is free (excluding currency conversions) to open a PayPal account and pay for an online purchase for those in the U.K. For merchants, with a PayPal option, your customers will have access to credit and debit cards, PayPal, Pay in 3, PayPal Credit and local payment methods. You can also use PayPal to accept recurring payments or subscriptions, and send invoices.

- Google Pay. Google Pay could do what a digital wallet does: send and receive money, store debit or credit card information for online or in-store purchases. Merchants do not have to pay any fees for accepting Google Pay payments online. However, for in-store purchases, card networks might charge merchants up to 4% as they consider Google Pay card-present transactions. To add Google Pay as a payment method, your website or online store must be able to add the Google API and must use a Google Pay-compatible gateway like 3dcart, Adyen, Stripe, Worldpay, BigCommerce, Shopify and WooCommerce.

- Amazon Pay is another way to facilitate customers’ payments without them entering their credit card information. It is especially convenient for Amazon users. Merchants are charged 2.7% plus 30p for domestic UK transactions if their turnovers online are less than £50,000 per month. Higher turnovers would merit custom discounts. If customers paid with a debit or credit card issued outside of the U.K., merchants would be charged a cross-border fee between 0.4% to 1.5%.

-

Bank Debits

Bank debits deduct the amount spent by a customer from his bank account directly to yours. Customers give their bank account information for a merchant to deduct automatically from the customers’ bank accounts at a specific time weekly, monthly, yearly, etc. Merchants or online sellers would usually send a confirmation message or email to customers of the amount deducted at the time of deduction even though customers have pre-authorized the debits.

Direct debit is suitable for subscriptions like memberships or software, recurring payments like bills, instalment payments and rent collection.

| Pros Of Direct Debit Payment Option | Cons Of Direct Debit Payment Option |

|---|---|

|

1. On-time billing. Businesses or service providers get paid on time without the need to chase after payments or track invoices. 2. Convenient for customers. Customers can 'set and forget' recurring payments without the fear of incurring late payment fees. 3. Less admin work. Businesses gain an average of one administration day per week when they switch to direct billing. |

1. Lack of global standards. There are different rules and regulations for direct debits in different regions and countries. Merchants opting for this payment method should be familiar with them. 2. Longer settlement period. Pulling money from a customer’s account takes more time than if they were pushing them out to merchants. You would get paid up in about 5 days. 3. Risk of getting an 'insufficient funds' notification after the settlement period. |

In the U.K., the most prominent direct debit payment method is Bacs (Bankers Automated Clearing Services). Retail payments authority Pay.UK owns and operates Bacs since 2018. Bacs is used to pay wages, salaries, pensions, state benefits, employee expenses, tax credits and insurance settlements. With Bacs, you are able to set a regular date for payments. It is also a cheaper way to make payments as the average price per transaction is 23p on average.

Besides Bacs, bank debits could also be made by CHAPS and Faster Payments. CHAPS transfers are settled on the same-day compared to 3 working days for Bacs. CHAPS is usually used for high-value transactions like buying a car or property. Faster Payments are mainly used for small value payments and payments are credited almost immediately. Faster Payments can be used for bills, supplier invoices and online transfers between bank accounts in the U.K.

-

Bank Redirects

Bank redirects are payment gateways that have an additional step of verification to complete a bank debit payment. At checkout, instead of entering bank account information directly, users are redirected to their online banking or payment gateway login page to authorize the payment.

These are some of the main types of bank redirects or online payment gateways:

- Hosted payment gateways. They direct customers away from your website’s checkout page to the Payment Service Provider’s (PSP) page where they confirm their payment details. When the purchase is paid, customers are redirected back to your website. PayPal is an example of a hosted payment gateway.

Pros: Secure, simple, and easy-to-setup. Transactions are Payment Card Industry (PCI)-compliant and protected against fraud.

Cons: Merchants do not have control over the whole user experience as hosted payment gateways are external operators.

- Self-hosted payment gateways.Payments are made on the merchants’ websites themselves. Customers enter their payment details which are collected and sent to the payment gateway’s URL. Examples of self-hosted payment gateways are Stripe-powered Shopify Payments and Quickbooks Commerce B2B Payments.

Pros: Merchants control the whole payment experience as all parts of the transactions are completed on the same website.

Cons: If you are operating the website on your own, you would need to have some technical know-how if there are any hiccups on the payment system. This is because technical support might not be available for self-hosted gateways, or you might need to hire technical support help for your website’s payment gateway.

- API-hosted payment gateways. Payments are processed using an API (Application Programming Interface) or HTTPS queries after customers enter directly their credit or debit card information on the merchant's checkout page. Stripe API and Square API are examples of API-hosted payment gateways.

Pros: Can be integrated with mobile, tablets, laptops and PCs for a smooth user experience. API gateways also give merchants full control over the user interface and the customer’s shopping experience.

Cons: Additional PCI DSS compliance and purchasing SSL certification requirements for merchants.

Top Bank Redirects Used In The United Kingdom:

Synonymous with payment gateways, and most accessible to all, PayPal is one of the most technologically advanced payment gateways. It boasts a 377 million strong base of active users and merchants. In a 2020 PayPal-commissioned Nielsen research of U.S. based merchants, PayPal’s customers convert 2.8x more when shopping with merchants who offer PayPal as a payment option. Customers trust PayPal as a secure payment option for them.

- Opayo (previously known as Sage Pay)

Opayo has top reviews on Trustpilot of 4.9/5. It is the payment processor for companies like easyJet, Europcar, Krispy Kreme, Murco Petroleum, and is the technology behind the BBC's Children In Need donation app. Opayo operates in the U.K. and Ireland. You could integrate Opayo’s payment processing system on your website or online store by 3 ways: Opayo Form (payment on Opayo’s payment page), Opayo Server (payment integrated in your own page), and Opayo Direct (you develop your own payment process with Opayo’s technology).

-

Buy Now, Pay Later

Buy now, pay later (BNPL) is a buying on credit payment option for online or in-store shoppers. Payments are split into instalments, usually interest-free unless not paid on time. Where previously the BNPL model was more commonly offered for big-ticket purchases, nowadays retailers are offering this credit payment option for small purchases like cosmetics and apparel too.

| Pros of Buy Now, Pay Later payment option: | Cons of Buy Now, Pay Later payment option: |

|---|---|

|

1. Access to a wider range of audiences. By offering instalments, buying expensive items are more affordable, especially for the younger demographic. 2. Correspondingly, as a merchant, the average order value increases. Klarna, a Swedish fintech company that offers BNPL, reported that retailers who partnered with Klarna saw an average increase of 68% in AOV with payments in three instalments. Purchase frequency too witnessed a 20% increase or customers choosing to pay in 30 days. |

1. Higher fees for customers and merchants. Compared to other payment methods, BNPL systems incur higher fees, generally 2-6% of the amount purchased. 2. BNPL encourages consumer debt. Buy now, pay later encourages consumers to buy more than they can afford, which usually means they do not have the actual means to repay the loans or instalments. Being in debt would affect your shoppers financially, mentally and emotionally |

Top BNPL Providers In The United Kingdom

For the U.K., Klarna offers online shoppers three payment options: in three interest-free instalments, in 30 days, or up to 36 months. As an e-commerce business, whatever payment option that your customers choose, you are always paid in full and upfront. you would also get access to millions of Klarna shoppers through integrated marketing campaigns.

Clearpay stated on their website that with the Buy Now Pay Later method, their retailers experienced an increase by 20% on average in cart conversion, and 40% increase in average order value. With Clearpay, customers need to pay a quarter of the price of purchase upfront, and the rest in 3 instalments over six weeks. Merchants will be paid ‘within days’ of the purchase.

-

Cash-Based Vouchers

Another way to accept payment online is through cash-based vouchers, or e-gift cards. Retailers like Argos, ASOS, Asda, Primark, Sainsbury’s, M&S and John Lewis accept e-gift cards. E-gift cards are used like regular gift cards, but the recipient would receive a digital card with a code through his email address rather than a physical card. He could then purchase items online with the e-gift code.

| Pros Of E-gift Cards | Cons Of E-gift Cards |

|---|---|

|

1. Vouchers provider or merchants who issue them would have received payment regardless whether the recipient uses the e-gift card or not. 2. Customers would usually shop more than the price of the e-gift cards. |

1. Exchanges and returns could be more complicated with e-gift cards. 2. Merchants may be charged additional fees by their e-commerce or shopping cart platform providers by issuing e-gift cards. |

Top E-gift Card Payment Option In The United Kingdom

Love2shop is accepted at over 100 major retailers with more than 20,000 stores across the United Kingdom. It is the U.K.’s top multi-retailer gift voucher and prepaid gift card issuer, where those who receive them can decide at which retailer they want to spend their gift cards at. There are four different types of vouchers available for customers to purchase: Love2shop voucher, Love2shop gift card, Love2shop e-gift card and the Love2shop contactless card.

-

Cryptocurrencies

Cryptocurrencies are digital tokens, they are not physical coins or cash. It is a decentralised digital currency, with no central authority or government regulating it. Cryptocurrencies are encrypted and secure, and run on peer-to-peer blockchain technology and could be used to buy goods and services or even traded. There is no standard value for cryptocurrencies and the price is set by the market’s demand and supply.

| Pros Of Accepting Cryptocurrency Payments Online | Cons Of Accepting Cryptocurrency Payments Online |

|---|---|

|

1. Increases conversion rate and user engagement. Triple A estimated that in 2021 there are currently over 300 million crypto users worldwide. Over 18,000 businesses already accept cryptocurrency payments. Giving more options to pay would only improve your business and appeal to more customers to buy from your online store. 2. Eliminating banks and service providers reduces transaction fees for merchants and customers. 3. Secure and fast transactions. Payments are received immediately and do not take days to be processed unlike traditional banks. They are also secure since blockchain technology tracks each individual coin and wallet, eliminating fraud possibilities and limiting chargebacks. |

1. Price volatility. Cryptocurrencies price fluctuates rapidly and the value of a crypto coin could halve even in 1 day of trading. Try not to hold cryptocurrencies for your business as it could cost you as a speculative investment. Immediately convert digital currency to its value in cash in real time when payment is made with service providers like BitPay or Coinbase. 2. Security. There are cases of crypto assets being stolen by cybercriminals, and an average of USD $2.7 million of cryptocurrency assets stolen every day in 2018. Regularly back up your data, keep your private keys safe, and turn on multifactor authentication when logging onto your digital wallets. 3. Regulatory Uncertainty. There is no universal law governing cryptocurrency and many countries are coming up with reporting, and taxation regulations and requirements regarding cryptocurrency. Bitcoin, for example, is accepted as a legal payment method in Japan. |

Top Cryptocurrency Payment Gateways In The United Kingdom

CoinPayments is an all-in-one digital currency payment solution with 3 million user accounts and merchants in 182 countries. It handles cryptocurrency payments and transactions, has a cryptocurrency trading platform and a digital currency storing wallet. Out of 5,862 crypto coins available today, CoinPayments supports 1,925 of them, with an industry-low transaction fee of only 0.5%. Its payment gateway is offered by major e-commerce platforms internationally, e.g. WooCommerce, Shopify and Magento.

With BitPay, cross-border payments would be settled within 48 hours. What sets BitPay apart is that merchants have the option of getting paid in GBP or 37 other fiat currencies instead of bitcoin. Bitpay will lock in the exchange rate at the time of transaction, accept customers’ pay in Bitcoin or other cryptocurrencies, and convert that transaction into fiat currency to be deposited directly into the merchant’s bank account.

What Are the Fees Involved?

Costs of accepting payments online vary between different online gateway providers. There are many fees associated with accepting cards and other payment types online. Most payment gateways and merchant accounts charge per transaction, on top of setup fees, monthly and annual fees, minimum transactions fee, and processing fee, among others. The standard transaction fee for online payments could be cheaper for merchants with volume discounts.

In the United Kingdom for example,

- U.K.-based PayPal merchants accepting payments locally will be charged 2.90% + 30p per transaction.

- BitPay merchants pay a 1% fee on all transactions.

- For Klarna, merchants are charged based on the payment options their customers choose. If their customers chose to pay in 3 interest-free instalments, merchants are charged 5.4% transaction value + 20p, 3.4% + 20p if they pay in 30 days, and 1.9% + 20p if customers pay over up to 3 years.

Do check out each payment gateway’s website for more details regarding merchant fees.

All set to choose that payment gateway? Great! We hope you found the best way to accept payments online that is suited to your business needs; we really wish you all the best!

Whenever you need help filing your company taxes or with the accounting for your UK company, we at East river are here for you. We will support your growth and take away all the administration pains of running your online store.