IR8A: Income Info on Your Employees

Section 68(2) of the Income Tax Act obliges all employers in Singapore to prepare income information for their employees. Every year the employer must prepare Form IR8A and supporting Appendix 8A, Appendix 8B, or Form IR8S (if applicable) for all employees by March 1.

It is the accountant who normally deals with payroll. If you outsourced accounting to a Singapore accounting service provider, consider asking about their payroll services.

What is IR8A?

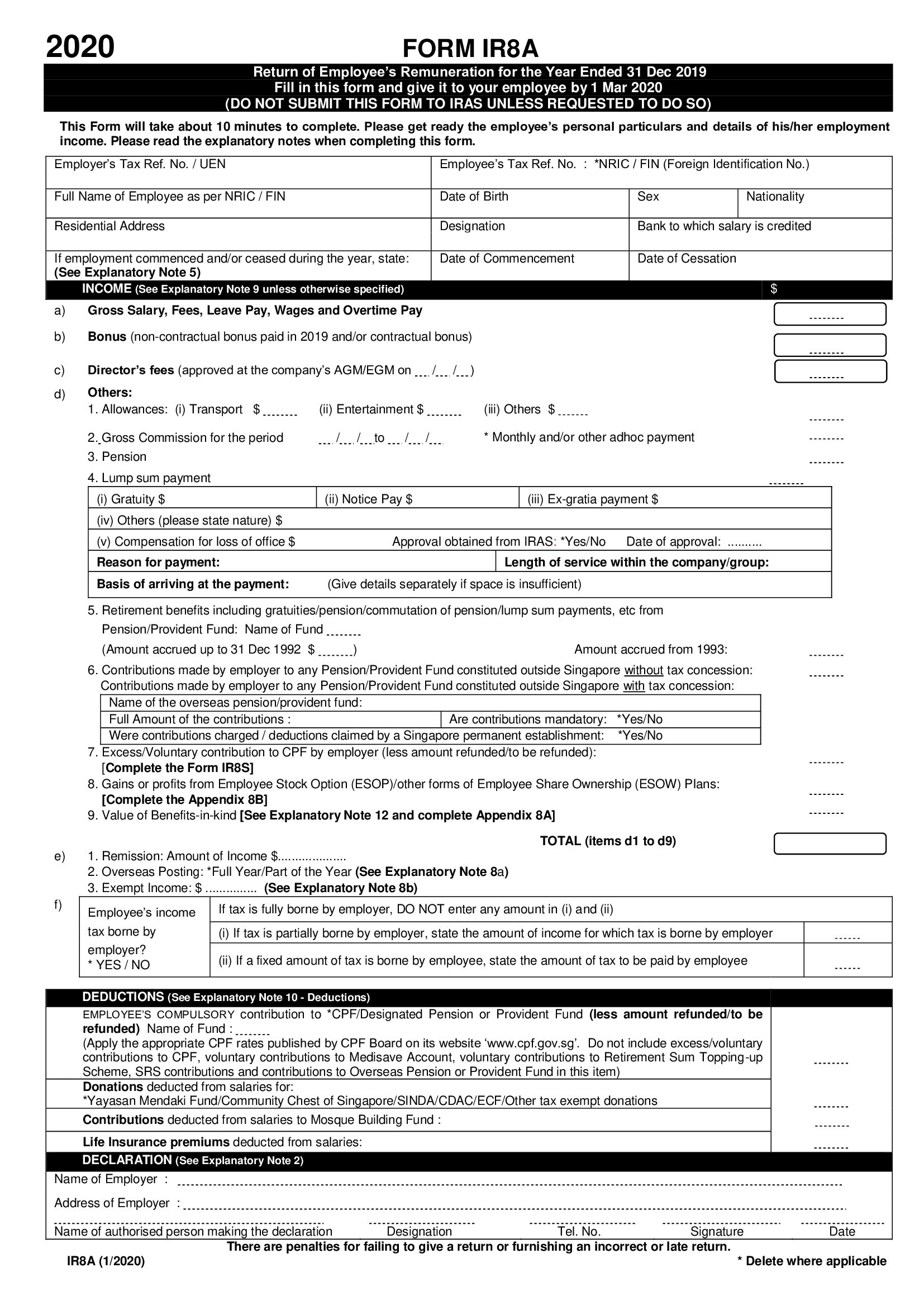

Form IR8A in Singapore is a mandatory document that contains information on employees’ earnings. Depending on various working conditions of your employees you might need to prepare Appendix 8A, Appendix 8B, and Form IR8S as well. They are issued by the employer and relate to employees’ income for the preceding year.

For whom does the employer prepare IR8A?

What about the income tax for you as a company owner?

It depends on your tax residency. Your income is also classified differently according to whether your company is a sole proprietor, or if you are a company director of your own private limited.

All employers must complete a Form IR8A for:

- full-time and part-time resident employees;

- non-resident employees;

- resident company directors;

- non-resident company directors;

- board members receiving Board/Committee Member Fees;

- employees who are working for the company while receiving a pension;

- employees who have left the company but should get income for the preceding year.

Those exclude:

- foreigners posted overseas after clearance who did not render any employment service in Singapore for the rest of the calendar year;

- foreigners who are contracted by a Singapore employer to be based overseas and rendered their employment services wholly outside Singapore for the whole calendar year;

- foreigners who have left the company where filing of Form IR21 is required. Form IR21 notifies the authorities that your non-citizen employee left the job and/or the country.

How to submit IR8A?

If you are registered for the Auto-Inclusion Scheme (AIS) for Employment Income, you can submit the information about your employees’ earnings electronically. There are a number of Human Resource Management Systems (HRMS) that can help you submit IR8A directly to IRAS.

One of the few IRAS-approved online tools that currently help businesses submit IR8A for free is Talenox. With Talenox, you won’t need to download an IR8A .txt file to validate through IRAS Auto-Inclusion Scheme (AIS) Java programme and upload it separately to myTaxPortal. After all, you can now submit tax with just a click of a button. Talenox will even help you ‘remember’ to prepare the form for employees who ceased employment before the year ended.

The data in the IR8A submission will be later used in personal income tax assessments.

The AIS for Employment Income allows employers to declare income information on employees with less effort in comparison to filling out the hardcopy forms. Also, the information is automatically updated on the tax portal, and employers don’t need to update it manually.

You can check if your company is registered under AIS for Employment Income via IRAS Service.

How do you know if you must follow the AIS for Employment Income? If you have 7 or more employees during the calendar year or got the “Notice to File Employment Income Of Employees Electronically”, you have to submit IR8A and supporting forms electronically.

Employers who are under that scheme should provide employees with IR8A copies for their reference of what is submitted.

Employers who are not under the AIS for Employment Income need to complete the IR8A Forms digitally or manually and then hand them to employees by March 1 of the following year. Employers need not submit the forms to IRAS.

What are Appendix 8A, Appendix 8B, and Form IR8S?

These three documents are filed together with IR8A for the same groups of employees provided that they match the descriptions below. If they do not, you only file IR8A for them.

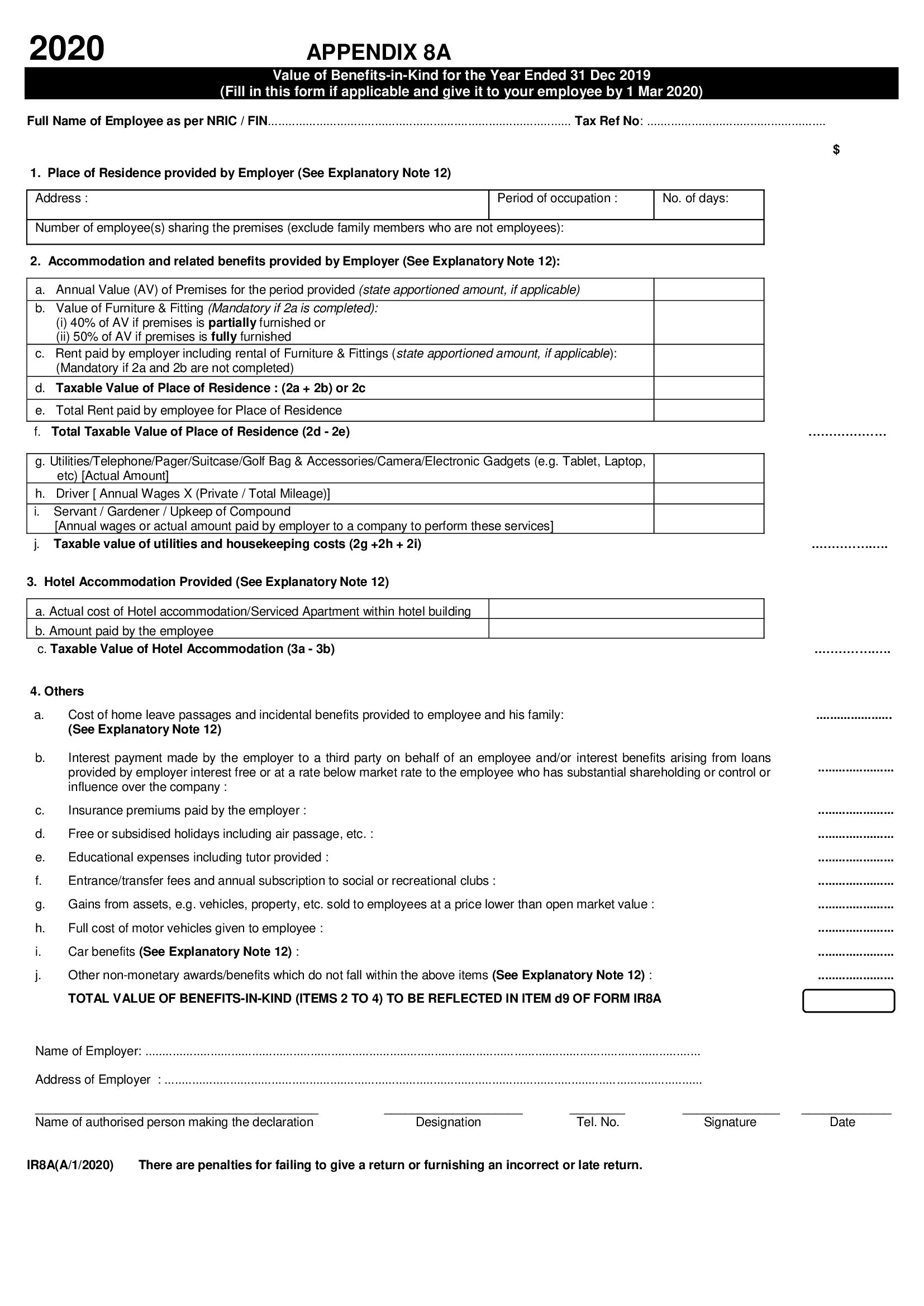

You must complete Appendix 8A if your employees were provided with benefits-in-kind — all the perks you offer them that are not salary: a gym membership, a medical insurance, a French class, etc.

Employers have to declare the benefits-in-kind in the Appendix 8A unless the benefits-in-kind are granted an administrative concession or exempted from Income Tax.

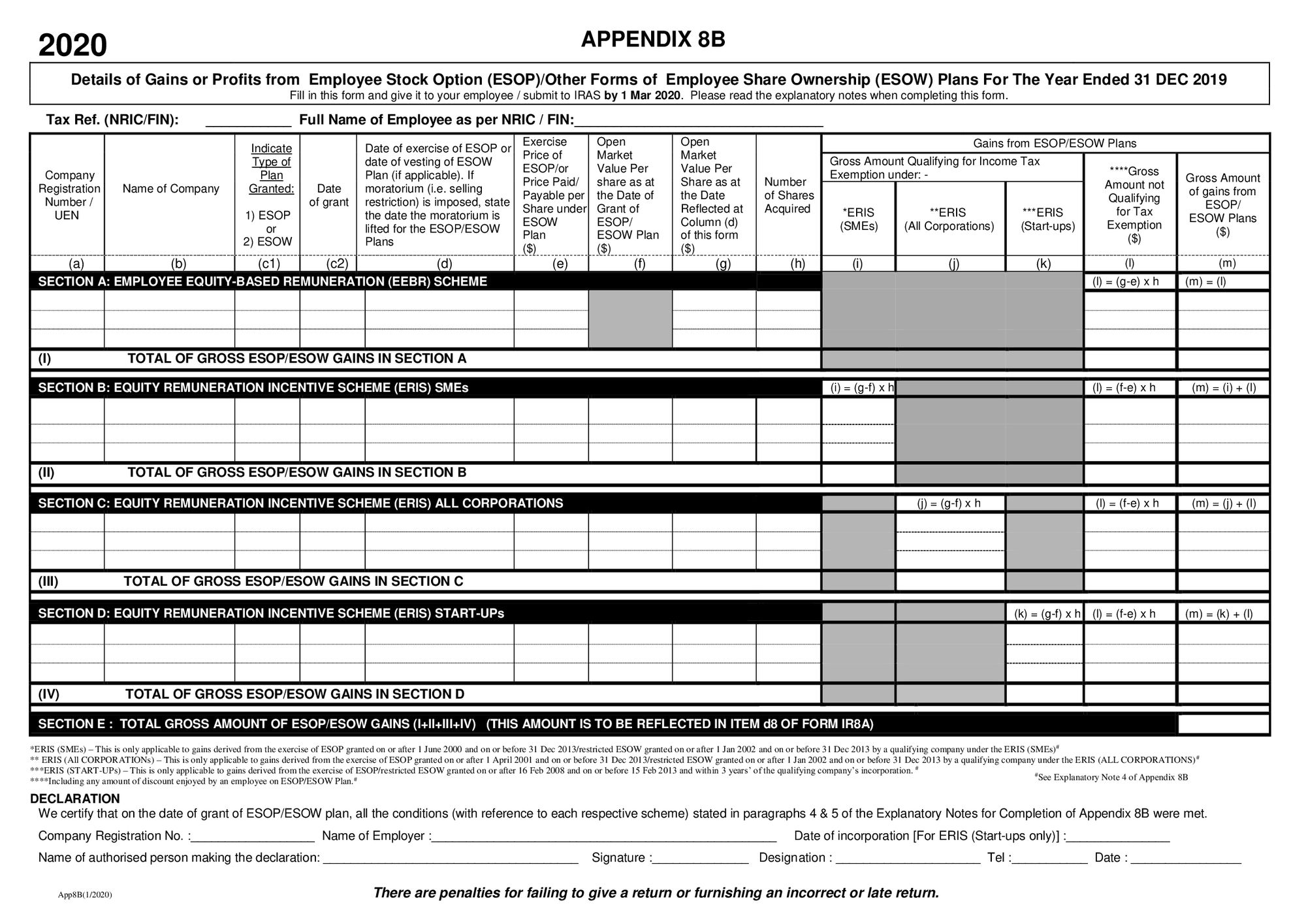

You must complete Appendix 8B if you are an employer who derived gains or profits from Employee Stock Option (ESOP) Plans or other forms of Employee Share Ownership (ESOW) Plans.

If an employee has ESOP or ESOW plans, he can own or buy shares in the company. Any gains or profits from the share option must be taxed.

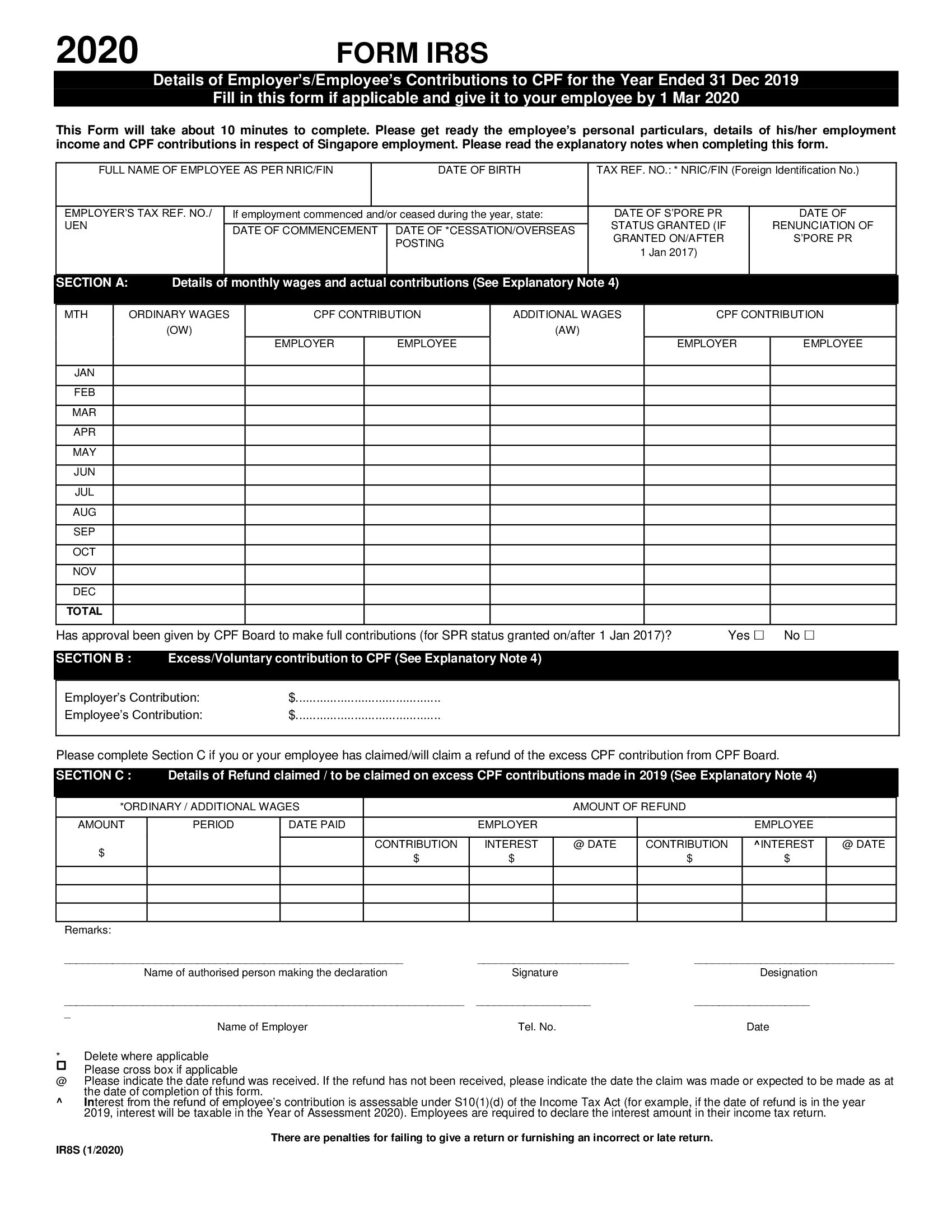

You must complete the IR8S Form if you are an employer who made excess CPF contributions on your employees' wages and/or has claimed or will claim a refund on excess CPF contributions.

What if I need to correct something after the submission?

If you need to make changes to your employee’s income information after having submitted the forms electronically, you can indicate the difference between the amount you reported and the actual sum.

“Mario’s Pizza&Pasta” wrongly indicated the income of its cook Antonio: the salary earned was S$35,000, yet the restaurant’s accountant put down S$31,000. When correcting his mistake, he will indicate in the amendment file that there are S$4,000 of difference.

“Mario’s Pizza&Pasta” paid out a S$8,000 bonus to Antonio but wrongly indicated S$10,000 in the IR8A. The amount in the amendment files should be -S$2,000. It’s high time Mario fired that accountant of his, isn’t it?

Alternatively, you can amend your employee income tax forms easily through a free-to-use, IRAS-approved online tool like Talenox. Take care to have this done before the deadline, 31 March.