A Guide to Income Tax for Foreign Company Owners and Directors in Singapore

Sometimes company founders forget about the personal tax they have to pay on their own salary, while paying all the other taxes on time for their Singaporean companies and businesses.

This article is for you if you want to know whether you have to pay tax in Singapore on your own salary and you are a foreign company owner.

What Is Considered Personal Income Tax for Company Owners?

Company Founders or Business Owners

Company founders or business owners (foreign or local, resident or non-resident) are considered as self-employed in Singapore, and they own sole proprietorship. When you are self-employed, you need to declare your business income as part of total personal income. Paying the tax for your business income is considered as paying your personal income tax. Self-employed individuals can take advantage of the Pre-filling of Self-Employed Income, which automatically transfers information on your income to the tax system.

Norman is a foreigner from France. He set up a digital marketing agency based in Singapore which makes around $100,000 in profits. He is responsible for declaring business income every year and paying personal income tax on this amount.

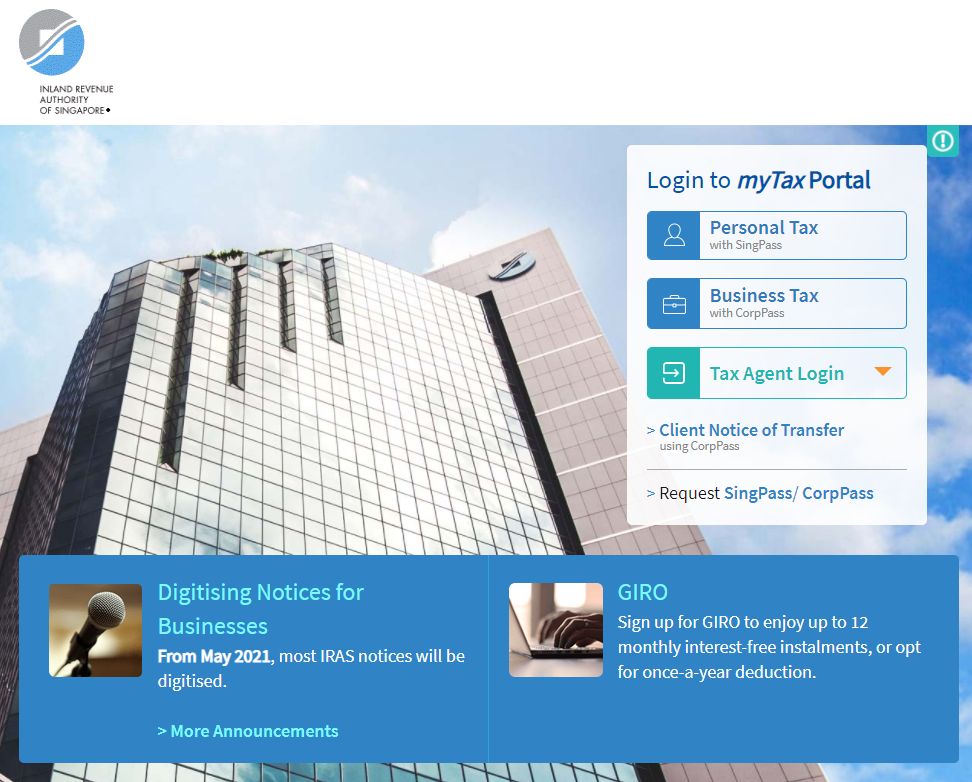

If you are participating in the pre-filling scheme, you can view your pre-filled information in the “Income, Deductions and Reliefs Statement (IDRS)” at myTax Portal.

For Company Directors

If you are listed as a director for a private limited company and you get a monthly salary or remuneration, you would be considered as an employee and will have to pay income tax annually on your gross salary. You would have to fill in Form IR8A from IRAS.

On top of salaries, Company Directors often receive benefits in the form of allowances, accommodation expenses, cars provided by employers. If you or your company’s staff receive benefits, they will need to file Appendix 8A and attach it to the above Form IR8A as well.

Verivan Pte Ltd provided acommodation for their Company Director who was employed for the period 1 Jan 2020 to 31 Dec 2020. The accommodation was fully furnished and shared by 2 employees. The Annual Value of the accommodation provided was $40,000.

| Place of Residence | |

| Period when the premises was provided: | Mar 2020 to 29 May 2020 |

| Number of days premises occupied: | 90 days |

| Annual Value (applicable to the employee) (2a) | $4,918.03 ($40,000/2 x 90/366) |

| Value of Furniture and Fittings (2b) | $2,459.01 (50% x $4,918.03) |

| Taxable value of Place of Residence (2d) | $7,377.04 |

| Less: Rent paid by employee (2e) | $2,000.00 |

| Total Taxable value of Place of Residence (2f) | $5,377.04 |

| Utilities (2g) | $ 250.00 |

| Gardener (2i) | $1,200.00 |

| Taxable value of utilities and housekeeping costs (2j) | $1,450.00 |

| Hotel Accommodation (3a) | $2,500.00 |

| Taxable value of Hotel Accommodation (3c) | $2,500.00 |

| Total value of benefits-in-kind (2f+2j+3c) | $9,327.04 |

Is Income Tax based on Net or Gross Income?

Taxable income starts with gross income, then certain allowable deductions are subtracted to arrive at the amount of income you're actually taxed on

What is an Accounting Period?

Generally, the accounting period is a 12-month period for which profits or losses are calculated. You need to keep records and accounts of your business transactions. These must be supported by invoices, receipts, vouchers, and other documents. Finally, at the end of every accounting period, you must prepare the statement of accounts comprising your profit and loss accounts and the balance sheet. By the way, if you need additional help for these corporate administrative work, we provide bookkeeping and accounting services to ensure that all these records are managed properly while you focus on growing your business.

Only the Income You Earned in Singapore is Taxable

Any income you earn in Singapore is income-taxable.

If you earn income from outside of Singapore, your income is taxable only if:

a) You receive it through partnerships in Singapore, OR

b) As part of fulfilling your job in Singapore, you need to travel overseas.

How Much Personal Income Tax Do I Need To Pay as a Company Director?

The income tax you pay depends on:

- Your tax residency

- The amount of chargeable income you have

What is Tax Residency?

Company directors in Singapore are taxed according to their tax residency status. First, let’s look at what it means to be a tax resident of Singapore.

If you have done any of the following, you would be considered a tax resident of Singapore.

- Stay or work in Singapore for at least 183 days in a calendar year OR

- Have continuously worked in Singapore for 3 consecutive years OR

- Have worked in Singapore for at least two calendar years AND your total period of stay (including your physical presence immediately before and after your employment) is at least 183 days.

| Income Tax for Foreign Non-Resident Company Directors | Income Tax for Resident Company Directors |

| Flat tax rate of 22%. | Taxed on a progressive rate based on chargeable income. |

Income Tax Rate for Tax Residents

If you are a resident company director , you will be taxed on a progressive rate based on your chargeable income below.

| Chargeable Income SGD ($) | Rate (%) | Gross Tax Payable ($) |

On the first 20,000 On the next 10,000 |

0 2 |

0 200 |

On the first 30,000 On the next 10,000 |

- 3.50 |

200 350 |

On the first 40,000 On the next 40,000 |

- 7 |

550 2,800 |

On the first 80,000 On the next 40,000 |

- 11.5 |

3,350 4,600 |

On the first 120,000 On the next 40,000 |

- 15 |

7,950 6,000 |

On the first 160,000 On the next 40,000 |

- 18 |

13,950 7,200 |

On the first 200,000 On the next 40,000 |

- 19 |

21,150 7,600 |

On the first 240,000 On the next 40,000 |

- 19.5 |

28,750 7,800 |

On the first 280,000 On the next 40,000 |

- 20 |

36,550 8,000 |

On the first 320,000 In excess of 320,000 |

- 22 |

44,550 |

Income Tax Rate for Tax Residents

As stated above, if you are not a tax resident of Singapore, your income tax is a flat rate of 22% on your gross income, no matter which part of the world you are a citizen of.

Ms Burch, an American, received Director's fee of $85,000 in 2019.

Her chargeable income for YA 2020 is computed as follows:

| Director's Fees | $85,000 |

| Less: Employment Expenses | $0 |

| Assessable Income | $85,000 |

| Less: Personal Reliefs | N.A. |

Chargeable Income (Assessable income less Personal Reliefs) |

$85,000 ($85,000 - $0) |

Ms Burch's tax payable on her chargeable income of $85,000 is calculated as follows:

| Chargeable Income | $85,000 |

| Tax Rate for Non-Residents (Director's Fees) | 22% |

| Net Tax Payable for YA 2020 | $18,700 ($85,000 x 22%) |

How and When To File Taxes?

Filing Personal Income Tax Returns

Check that your personal annual income is S$22,000 or more for the financial year. If it has exceeded this, you will have to file a personal income tax return which needs to be submitted to the Singapore tax authority by the 15th of April of the year.

Even if you do not have any income in previous years, you will still need to declare zero income in your tax form and submit by 15 April (paper) or 18 April (e-filing). It is compulsory to submit the return, and submit it on time, no two ways of going around it. There will be penalties from IRAS otherwise, which could also escalate to legal actions.

You can choose to file your returns online or by mail. IRAS will send you the appropriate paper tax form, upon request, the online form will be available from 1 March every year.

- For tax resident individuals – Form B1

- For self-employed – Form B

- For non-resident individuals – Form M

After you have filed your returns, you will receive your Notice of Assessment or tax bill in May to September. The tax bill will indicate the amount of tax you have to pay, and you would need to pay the full amount of tax within 30 days of receiving your Notice of Assessment.

How to Pay Tax?

- GIRO (General Interbank Recurring Order) is the preferred method of payment. GIRO deductions for tax could be applied via:

- myTax Portal

- Internet Banking (DBS/POSB, OCBC and UOB)

- Electronic Payment Modes include

- PayNow QR

- Internet Banking Bill Payment

Internet Banking for tax payment is made available by the following banks: BOC CIMB Citibank DBS/POSB HSBC ICBC MayBank OCBC RHB Standard Chartered Bank State Bank of India UOB

(Only DBS/POSB, HSBC, OCBC, Standard Chartered Bank and UOB are applicable for corporate account holders). - AXS Station

- AXS e-Station (Internet) / AXS m-Station (Mobile)

- Credit card

- Telegraphic Transfer (Only for payments from overseas where the payment modes listed above are not applicable).

Tip

To ensure that you are always up-to-date with the current tax requirements and obligations, and to avoid forgetting to pay taxes on time, we at East river could provide you with bookkeeping and taxation services that you require, so that you could focus on the most important thing: running and growing your business.