P11D Form: All You Need to Know If You End up Googling It

Whenever you pay for your employees’ gym, or buy them smokings for fancy parties, or offer them a corporate car, you do things that are to be reported using P11D forms. The P11D form is one of the payroll documents your accounting services provider must prepare for HMRC.

What is a P11D form?

It is a record of so-called “benefits in kind” (like company cars or medical insurance) that an employer gives to any of their employees or directors (whose job is considered a separate tax entity). The “benefits in kind” are those perks that are not included in the actual salary. But these perks are of a monetary value, so many of them are subject to tax.

The employer is to provide the P11D forms both to HM revenue and customs and to the employees. If an employer already takes the tax on one’s benefits out of one’s pay, the company doesn’t give the P11D form to that person.

You can save yourself the pleasure of filing the P11Ds if you choose to keep track of employees’ benefits via a payroll system. But you will still have to file P11D for living accommodation and interest-free & low interest (beneficial) loans.

What is to be included in a P11D?

Among the perks you are to find on a P11D there are company cars, health insurance, travel and entertainment expenses, childcare, etc. The benefits in question make a long list, not to forget that you also need to find out if you need to pay taxes or National Insurance contributions on them. You can check out all the details in the government’s guide, or turn to your accountant for that.

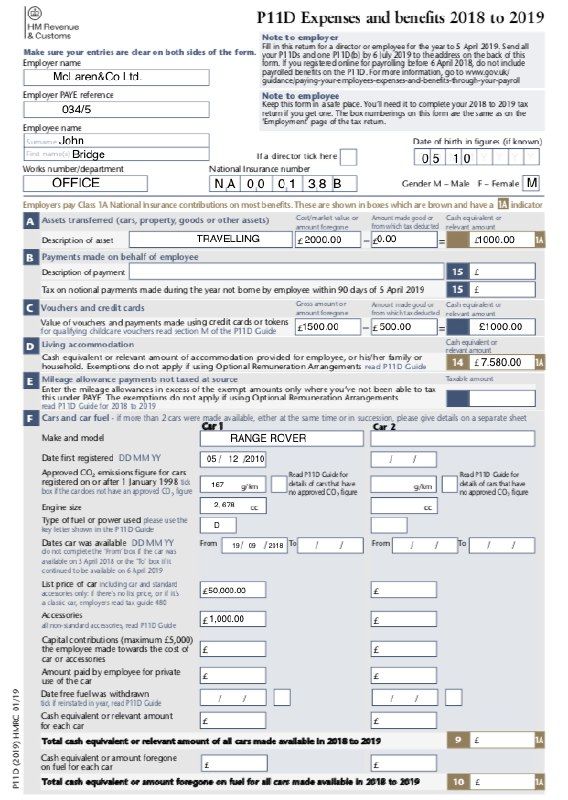

John works for McLaren&Co Accounting firm and has a 12-months gym membership paid up by the employer. John has improved his back pain thanks to the swimming pool and weight training — that is viewed as a direct benefit for him as an employee and must be included in his P11D form.

Once on Friday, John goes to a business meeting with Amy. He has to pay for the parking, so he brings the bill to the company and gets the money reimbursed — this money is not to end up in his P11D form. (Thanks for Mr Mclaren, John didn’t have his own corporate car, because reporting it is a hell of a way to take).

Here is what there is to find on a P11D:

- Employer’s name

- Their PAYE reference

- Employee’s name

- Employee’s National Insurance number

- Employee’s date of birth

- Employee’s gender

- Details of the provided benefits provided (e.g. cash equivalent/cost)

This is the first page of a 2-page form to give you an impression of what it looks like.

What is the due date for a P11D form?

The employer is to provide the forms for a tax year, which starts on the 6th of April and ends on the 5th of April next year. The P11D filing deadline is the 6th of July.

HMRC will wait till the 19th of July, and if they don’t get the papers by that time, here the penalties come, monthly. The sum is £100 per 50 employees for each month or part month: for example, if you are late with the papers for one calendar month and 6 days, it might be considered that you are late for two months.

There is also a form known as P11D (b), which is needed if there are any national insurance contributions (NIC) to be made from the benefits on P11D, or if you are liable to return any payments on P11D. If a company doesn't submit P11D (b) on time and doesn't pay the due NIC, it will get a fine of 5% from the sum for the first 30 days. If the form and the contributions still don't make it to HMRC, an additional penalty will be imposed.

| What Jack McLaren needs to do | Deadline |

|---|---|

| Submit P11D form to HMRC | 6 July following the end of tax year |

| Giving employees the copies of the doc | 6 July |

| File in P11D (b) forms to inform HMRC on what Class 1A National insurance he owes | 6 July |

What else to keep in connection with a P11D form?

HMRC may ask you to see evidence of how you accounted to them for each of the benefits. That’s why you need to keep a close record of all the information that might be important. Like, when you cover an employee’s travel expenses, you are to keep a record of when and what for this trip was made and keep the receipts as evidence. Such records must be kept for 3 years from the end of the tax year they relate to.

How to deal with any mistakes in a P11D or a P11D (b) form?

First of all — DEAL with the mistakes. If HMRC finds out you filed inaccurate information in your tax return and paid not enough tax or got too many tax reliefs, you will face penalties. Both if it was done carelessly or on purpose. Calculating a penalty, the authorities will take into account the degree of your wrongdoing.

| % of potential revenue lost | Degree of wrongdoing |

|---|---|

| 100% | Deliberate and concealed action |

| 70% | Deliberate, but not concealed action |

| 30% | Careless action |

| 0% | Genuine mistake and full cooperation with HMRC |

Filing the corrected versions, you should:

1) For P11D, mention ALL the benefits and expenses, not just the one you need to correct.

2) For P11D(b), mention THE TOTAL amount you need to pay, not just the amount you forget to include.

McLaren & Co sends a P11D with a £600 gym benefit for John and a medical benefit of £300. He makes a mistake and puts the medical expenses at £200. Filing the corrected version, he should not forget to include both of the benefits with the right sums, not just the medical one.

McLaren & Co also files a P11D(b) form, showing John needed to pay £2,000 of national insurance contributions. He forgets another £500 and wants to include them. The final sum on the corrected paper should be £2,500.

By the way, we provide company incorporation services in the UK. Trust us all your paper fuss.