Withholding Tax in Singapore

When you transfer money to a non-resident of Singapore (either an individual or a company), withholding tax is what the Inland Revenue Authority of Singapore (IRAS) will ask you to pay.

We take a deeper look at what payments are subject to withholding tax, who is considered a non-resident, and what the deadlines are.

If reading about taxes does not excite you like it excites us, consider getting outsourced accounting services in Singapore right away. If that is not the case, let's plunge in withholding tax!

What types of payments are subject to withholding tax?

Who is considered a non-resident?

How does withholding tax interact with DTAs?

What are the IRAS forms for the WHT filing?

What are withholding tax deadlines and what are the penalties for being late?

What if the payment is made in a foreign currency?

What if I make multiple payments in 60 days?

What about partnerships?

Conclusion

What is withholding tax?

Withholding tax (WHT) is a tax on payments made to non-residents of Singapore (including employees, business partners, and overseas agents — those who act on behalf of a company).

As non-residents do not pay their WHT taxes directly to IRAS, it is the obligation of the payer to do it. The payer takes the tax out of the sum he is to pay to a non-resident.

Sam is to pay S$2,000 to her graphic designer Jack, who is based overseas. Sam must pay IRAS 17% of WHT on this payment, or S$340. So, Sam deducts this money from the payment and gives S$340 to IRAS and S$1,660 to Jack.

What types of payments are subject to withholding tax?

There are several types of payments that will be taxed.

Each of the payment type has its own tax rate.Here is what you must pay the WHT on.

- Payments for services, interest, royalty, rental or movable properties, etc. In each of these cases, the amount of tax is different. But will be originally charged at 15%.

- Payments to non-resident employees. This includes non-resident directors, any type of professionals, public entertainers and international market agents.

- Distribution of Real Estate Investment Trust (REITs). This applies to payments to non-resident trust unit-holders (people/companies who hold a part of a trust property like shareholders have shares in a company).

There is no withholding tax on dividends.

Who is considered a non-resident?

Residency of the person/company you pay is the key factor to determine whether the deal is subject to withholding tax.

Non-resident company. Talking about the residency of a company here, we mean the tax residency status, which is basically determined by the place where the business is controlled and managed. So it’s not enough to just be incorporated in Singapore to get a tax residency status. Companies registered outside Singapore also fall under this category. So, this category refers to:

- Foreign-registered companies, operating in Singapore

- Singapore-registered companies, managed and controlled outside Singapore

- Singapore branches of foreign companies

Non-resident individuals. This refers to any kind of foreign professionals working under the contract of service, including public entertainers (like singers, dancers, musicians) and foreign board directors.

There are tax exemptions for arbitrators and mediators.

How does withholding tax interact with DTAs?

DTAs (or Avoidance of Double Taxation agreements) are tax agreements between Singapore and other countries that ensure individuals and companies are not taxed twice on the same income or that a lower WHT rate applies.

Thanks to the DTAs, there are some exemptions from WHT for non-resident professionals. An exemption or reduced rate is granted only if there is an article specifying the type of income in the DTA.

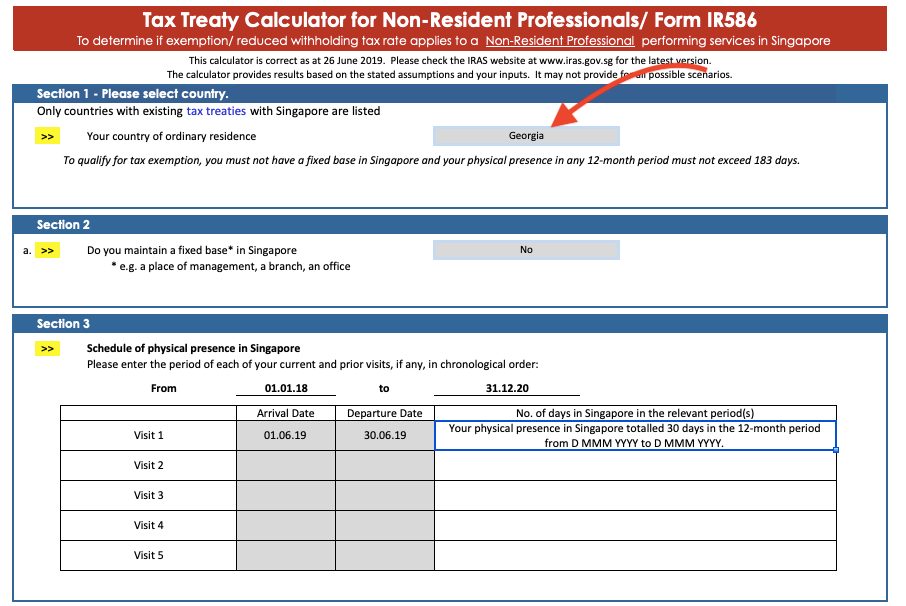

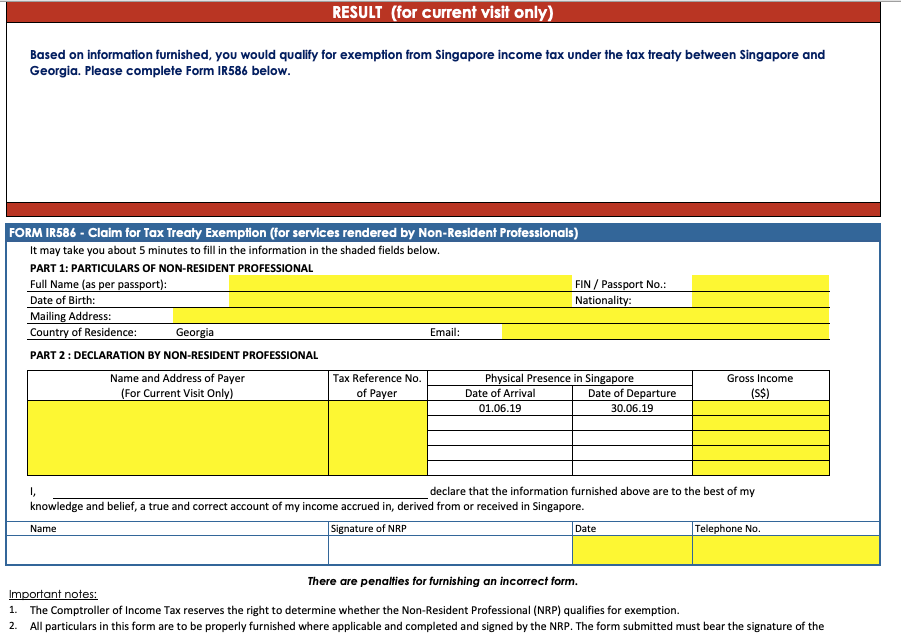

IRAS offers a calculator for a non-resident, for you to find out whether you are eligible for such exemptions. You start with choosing the country.

If you meet the conditions for an exemption, the calculator offers you Form IR586. The non-resident should complete it, print it and give it to you. You don’t need to submit the form to IRAS when asking for tax exemption on behalf of the non-resident, but you should be ready to provide it if requested.

If you are interested in the logic behind the calculator, check out the IRAS flowchart.

To claim the exemption under the DTA, one needs to do the following:

- The foreigner must provide the payer with a Certificate of Residence (COR), to prove that they are from the treaty country.

- This certificate must be certified by the tax authority of the payee’s country of residence.

- The payer must submit the COR to Singapore’s tax authority, IRAS.

What are withholding tax rates?

It is the type of payment that defines the withholding tax rate.

| Nature of payment | Tax rate |

|---|---|

| Interests, commissions, and any other debt- or loan-related fees | 15% |

| Royalty, rights of use, and intellectual property | 10% |

| Rent or other payments for the use of moveable properties | 15% |

| Payment to a non-resident director | 22% (20% prior to 2016) |

| Payment to non-resident professional/Foreign firms (unincorporated) | 15% on gross income or prevailing non-resident individual rate on net income |

| Payment to non-resident public entertainer | 10% on gross income (till 31 March 2020) |

| Commission/payment to non-resident international market agent | 3% |

We’ve given the basic outline of withholding tax rates, IRAS provides more rate figures.

What are the IRAS forms for the WHT filing?

When you pay withholding tax to the government, you report the amount of the payment through special forms. The basic one is known as S45 form, however, there are other types of forms depending on the type of payment you made.

| Type of payment | IRAS form |

|---|---|

| Interest, management fees, royalties, etc. | Form IR37 |

| Disposal of real property, consideration paid to non-resident seller | Form IR37A |

| Withdrawals from Supplementary Retirement Scheme (SRS) | Form IR37B |

| Payment to non-resident foreign professional or any foreign firm in Singapore | Form IR37C |

| Payment to Foreign Public Entertainers | Form IR37D |

What is considered the date of payment?

The exact date of the payment is important for your paying of WTH, as if you are late, IRAS might impose penalties on you.

To figure out the date of payment for each particular case, you must consider the earliest one of the following dates:

- The date stated in the contract if you have one.

- The date of the invoice if you don’t have a contract.

- The actual date when the income was credited to the account of the non-resident you’re paying.

- The date of the actual payment.

When paying the foreign director’s fee, the date should be chosen between the payment date or the date of approval of the payment as voted at the Annual General Meeting of the company.

What are withholding tax deadlines and what are the penalties for being late?

When should I pay withholding tax in Singapore?

Withholding tax must be paid by the 15th of the month following the date of the payment.

Sam paid his overseas accountant on the 20th of April 2019. Sam must pay withholding tax to IRAS by the 15th of May 2019.

If the deadline is missed, IRAS will send you a Demand Note and include the late payment penalty, which stands at 5%. An additional 1% penalty will be charged for each full month of non-payment. However, the final penalty will not exceed 15%. The penalties are calculated on the initial sum of the tax you were to pay.

Sam paid his overseas accountant S$10,000 on the 2nd of May 2019.

He is supposed to pay the WHT (15%, or S$1,500) to IRAS by the 15th of July, yet he does it on the 25th of October.

Sam gets a 5% penalty for missing the 15th of July deadline. Then, he doesn’t pay it for two full months in a row — August and September — аnd gets an additional 2% of the penalty, 1% for each month.

When Sam pays the WHT on the 25th of October, he pays 7% of penalty, or S$105. In total, S$1,500 + S$105 = S$1,605.

If the tax is not paid for more than 15 months, IRAS may take further actions:

- Appoint a special agent (like your bank or lawyer) to pay the sum to IRAS.

- For Sole-Proprietors or partners — issue a travel restriction order (TRO) to stop the person from leaving Singapore with the debt.

- Take the case to court.

You may also apply for a waiver on your late payment penalty. And though IRAS might waive the penalty only in exceptional cases, there are factors that might help them reconsider the decision, such as this mistake being made for the first time.

Sam is late for his withholding payment filing — his accountant violated the deadlines. It is the first time Sam did not pay on time, and he applied for a waiver — and gets it. IRAS approves his request because it was for the first time and Sam has been paying his overdue tax in full and on time and he assures the body that it won’t happen again as he signed up for GIRO, which will bring down the risk of making mistakes.

Where to pay your withholding tax?

You can fill and pay your WHT online through the myTaxPortal owned by IRAS.

If you have any questions, you can always call IRAS hotline.

Tip

Does WHT calculation seem difficult? Count your withholding taxes using a simple withholding tax calculator on IRAS website.

What if the payment is made in a foreign currency?

Both filing and paying of withholding tax in Singapore must be made in Singapore dollars. If you paid your counterparty in any other currency, use the prevailing exchange rate on the day you made the payment to calculate how much withholding tax you owe. Although, it is easier and usually more profitable for you to initially pay in Singapore dollars.

What if I make multiple payments in 60 days?

If you make several payments to the same non-resident professional within 60 days, you can present the sum to IRAS as one and file one withholding tax form for this money. The deadline for such payment will be the 15th of the next month after the month when you made the last payment to the non-resident.

Sam invites Eminem for his corporate birthday party on 1 November. Then Sam decided it is worth inviting him to the Christmas party as well, which was held on 24 December. Sam and Eminem’s contract says the payment is made on the day of the event. The deadline for Sam to pay withholding tax will be 15 February.

What about partnerships?

If your business is registered as a partnership and has at least one resident partner — you get a waiver on withholding tax. However, you should still file the amount of the payments that WHT might be applicable to.

If the partnership comprises 100% non-residents, the payments made to its members are subject to withholding tax.

If the structure of your partnership changes, you must notify IRAS straightaway.

Conclusion

- A Singaporean business paying to foreign companies and individuals must pay withholding tax to IRAS. How much the business will pay and what forms it will file depend on the nature of the payment.

- You can reduce the tax if your counterparty is a resident of a country that signed an Avoidance of Double Taxation аgreement with Singapore.

- Don’t forget about the deadlines, because if the date for filing and paying withholding tax is missed, IRAS might impose penalties on you.