How to Set up Alipay & WeChat Pay for Your Business in Singapore?

If you have clients from mainland China, offering them the preferred payment options like WeChat Pay and Alipay is a way to boost your business. The Chinese visiting your website or your offline shop in Singapore will have fewer problems paying and are likely to buy more. A customer just scans a QR-code and whoosh — the payment is done. So how can a Singaporean company set up the Chinese wallets? Here are a few tips.

Before we begin telling you how to do it all by yourself, if you want to save some time, you can always call on us for our financial and accounting services!

By Opening a Chinese Bank Account

You can integrate the usual ways of payment in China by opening a Chinese business bank account — something you can do without actually being registered as a company in the country.

However, our signed agent in China emphasizes that you might face a number of obstacles in the process.

In China, banks open 2 kinds of accounts for overseas companies: OSA (offshore accounts) and FTN (free trade zone no-resident accounts). In order to prevent money laundering and other crimes, any opening of such an account falls under a thorough examination. There are two types of companies, though, that will find it easier to open OSA or FTN in China. First is an overseas company that has established a WFOE (Wholly foreign owned enterprise) or JV (foreign-Chinese joint venture enterprise) in China. The second type of a company which has high chances of getting a Chinese bank account is a Chinese domestic enterprise that went overseas and established an overseas company there.

Wang Executive

Partner

The list of documents you will have to provide is not the same for all banks, but you will certainly have to provide your company registration documents as well as information about the company structure. Any yuan accounts opened by foreign entities need to be approved by the State Administration of Foreign Exchange. You will also have to be personally present to open the account.

Without Opening a Chinese Bank Account

Get a Merchant Account in a Singaporean Bank + Payment Gateway

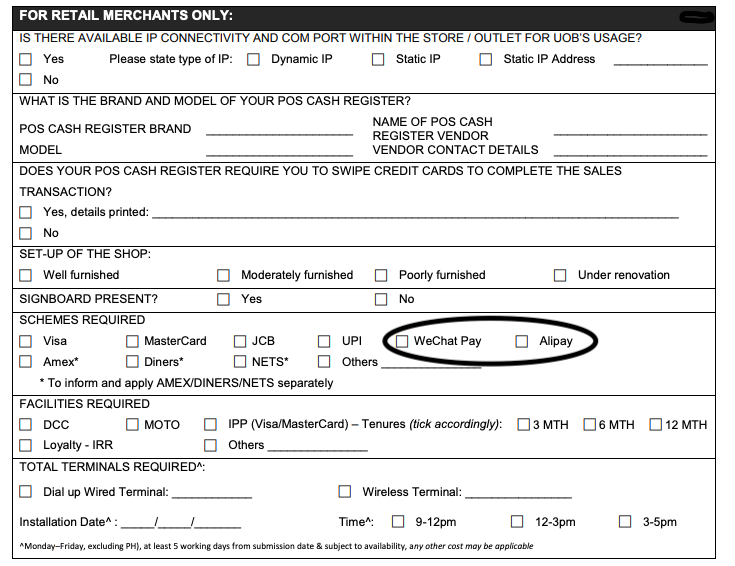

A Merchant Account allows a company to get and process credit & debit card payments from its clients and partners. Most Singaporean banks offer you this option and it’s usually used for e-payments. Here’s an example of a form you will need to fill in:

However, one might find this option too time-consuming: in order to open a Merchant bank account, a bank would usually require a copy of your company profile from the ACRA database, and then they might require as many additional documents on your business activity as they want until they are satisfied with your credibility. Additionally, in order to cover possible transaction risks, the bank will most likely require a deposit. However, you can’t transfer the money directly to your Merchant Account via Alipay/WeChat Pay. To do that, you will have to turn to a payment gateway, a company that will become an intermediary for your e-transactions.

Use Only a Payment Gateway

Payment gateways, which play an intermediary role between you and the client, are e-commerce service providers, facilitating the way you make and get e-payments. There are those who require you to open a Merchant account yourself, and those who offer you theirs, e.g. Stripe and FomoPay. Their software supports the transactions in every way (technical, banking, etc.) and they assume all the risks for you. They charge a fixed fee + a percentage fee for each transaction. For example, for a Singaporean company, Stripe’s charge is 2.2% + S$0.35.

When setting up Alipay and WeChat payments, we, as a technology company, decided to use a payment gateway. It's quite simple: you integrate with it via a single API, and then start accepting payments. Downstream it has multiple integrations with banks, Alipay, WeChat Pay, Apple Pay, Google Pay etc. and a secure infrastructure to manage all of it. Technically speaking, for an SMB, it’s easier, of course, to maintain one integration with, say, Stripe, than separately with each of the payment systems.

How the Integration with Intermediaries works

- You find a payment gateway suitable for you.

- You let them know what local bank account you have.

- You ask your local bank to approve Chinese payments to your account through the chosen intermediary.

- The intermediary gets money from Alipay and pays it back to you through your local bank (you see that the intermediary pays you).