East river + Aspire =

Open a company and a business account online on the same day

No office visits, no paperwork needed: your ready-to-go Singapore business set up within 24 hours

- FA20170653

- Xero Platinum Partner

- Our accountants are certified by ISCA

- License No. 19S9930

- Pioneers of Cloud Community Network

We take care of all the routines

Services Overview

Aspire is Southeast Asia’s 1st business neobank that serves SMEs with convenience and simplicity to manage their finances with the Aspire Account. Opening an account is free, 100% online, and done within 5 minutes!

On top of the account, you can get the Aspire Visa Card, Aspire FX with the lowest FX fees in the market, and the Aspire Credit Line financing solution to help you grow your business.

No deposits,

no hidden costs

We don't charge a deposit for the Nominee director service. Government fees for incorporationa and name-cheking are included. You always pay what you see.

Business account

Same-day opening by Aspire

FREE

Incorporation

Includes full service for 1 year:

- Unlimited Company Secretary

- Nominee Director

- Registered address

- Company registration

S$2,550

Accounting

A must-have with the Nominee director service. Covers 1 year of bookkeeping, accounting, and tax

S$800

Here’s what our customers say

Q&A

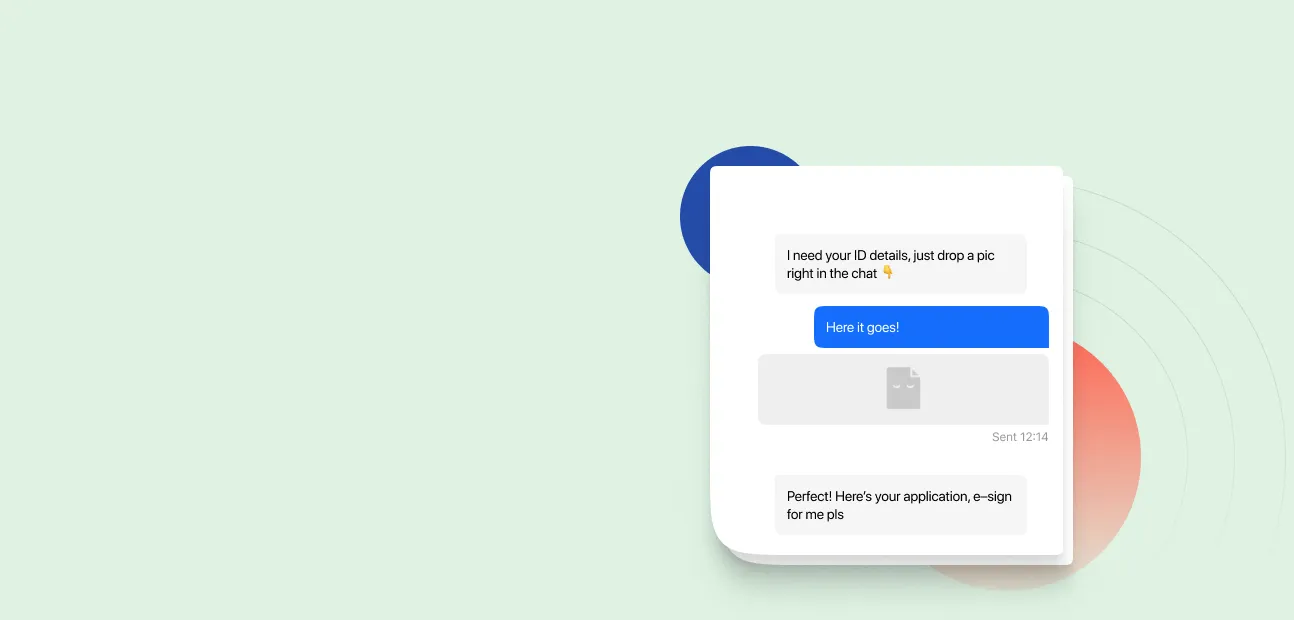

What is the process exactly?

We check that the company name you’ve chosen is available. You send us your IC or passport copy, details on directors and shareholders. We prepare all the necessary documents, send them to you for electronic signature, and submit them to ACRA (a government entity that registers companies). On your end, it’s just a message thread in a secure chat. Once a UEN has been issued, your company is operational.

How long does it take?

We can set up a company as fast as within 1 hour. The most important factor is to collect all the docs: once you’ve handed them over to us, we can act fast. Keep in mind that the authorities only process registrations during working hours.

Can foreigners start a business in Singapore?

Singapore is very welcoming to foreigners who want to incorporate. Foreigners can become directors and shareholders here without any restrictions. The only requirement is that each local company must have at least one resident director — a Singapore national or a Permanent Resident. To comply with this law, you can hire a Nominee director.

Do I need a resident director (Nominee Director)?

Your company can have as many directors as you want, but at least one needs to be local. If you do not have someone who can play the role, hire a nominee director. For example, there can be two directors: you and the nominee. If you apply for an Employment Pass from your new company, you only need the nominee service while you wait for it (about 6 months). After that, you can be the only director.

A nominee is a Singapore resident who holds the director’s position in your company but doesn’t get involved with your business. His responsibilities are to abide by the law and to always act in the best interest of your company.

Do I need a company address?

Yes, all Singaporean companies must have a local registered address. It goes on all legal documents. If you don’t have an office address, use our service. We handle your incoming letters, scan and store them in your East river account so you have easy access to all your documents.

What is an Aspire Account?

The Aspire Account is a business payment account that allows you to receive and send money through the Aspire App and the Aspire Visa Card.

What are the fees involved for opening an Aspire Account?

Registering for an Aspire Business Account is completely free. There are no monthly or fall-below fees.

How long does it take for my account to be approved?

Accounts are typically approved within 2 business hours. Accounts opened using MyInfo are approved immediately.

Is Aspire regulated by MAS?

Aspire FT Pte. Ltd. is currently carrying on business under an exemption granted by the Monetary Authority of Singapore and is currently exempted from holding a licence to provide payment services under the Payment Services Act (No. 2 of 2019). Aspire FT Pte. Ltd. continues to provide such services pursuant to the Payment Services (Exemption for Specified Period) Regulations 2020.

Aspire Financial Technologies Pte. Ltd. is an excluded moneylender under the Moneylenders Act (Cap. 188). Under the Moneylenders Act, Aspire does not require a moneylender's license as we lend solely to corporations and limited liability partnerships.

How are my monies safeguarded?

Aspire adheres to the safeguarding requirements set forth in the Payment Services Act (No. 2 of 2019) and the relevant MAS guidelines on the same. Your monies are deposited in a trust account with DBS Bank Ltd, and you are the beneficial owner of the monies held in the account.

It may be worth also noting that your monies are kept strictly segregated in a trust account in a safeguarding institution, as prescribed by the Payment Services Act, and in line with MAS best practices. You are the beneficial owner of these monies and any potential insolvency of Aspire would not affect the beneficial ownership of the said monies.