XBRL filing and standards in Singapore

We help Singapore businesses understand what the XBRL filing requirements are, and organise these processes with our outsourced accounting

- FA20170653

- Xero Platinum Partner

- Our accountants are certified by ISCA

- License No. 19S9930

- Pioneers of Cloud Community Network

What Is Full XBRL / XBRL Highlights? How does it impact businesses in Singapore?

XBRL or eXtensible Business Reporting Language is a standardised format for financial reporting that is mandatory for almost all businesses in Singapore. The XBRL filing system has been widely adopted across the globe by governments, business organisations, analysts, accountants, and more – making it the open international standard for digital business/financial reporting.

How to file Full XBRL or XBRL highlights?

XBRL filing must be carried out on ACRA’s special portal BizFinx. XBRL format requires a deep understanding of accounting as well as the software. We recommend to hire a professional and experienced bookkeeping and accounting service in Singapore. However, ultimately the legal responsibility for filing the documents with ACRA lies with the directors. You must understand them enough to check before submission.

Don’t want to do XBRL yourself anymore? We prepare and file it for you

We take over the paperwork routine, show real numbers, send reminders, and give active advice. All our prices are transparent, so no extra charges out of the blue.

I want to try

You get a personal accountant

A Chartered Accountant assigned to your company will track filing deadlines, suggest tax exemptions, and prepare reports

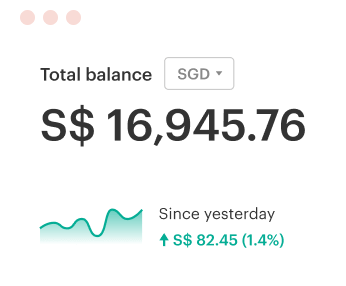

You see how much money you have

We collect data from your different banks and show today’s joint balance and its daily trend

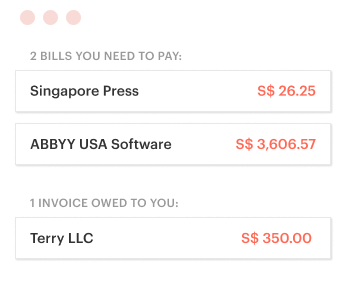

You see actual list of all unpaid invoices

We show daily updates on the invoices you need to pay, the ones due to you, and their totals

Accounting plans that match

the size of your business

You don’t measure your business by the number of transactions, so neither do we. Our accounting packages are tied to your revenues. Pick a monthly plan to receive regular financials, or an end-of-the-year catch-up accounting to submit neat reports. All our packages come as they are, no extra charges — simple and straightforward.

What’s your average monthly ?

Need more?

Additional services you may need

Get more- Multicurrency accounting S$200/y

- Dormant Accounting S$300

- Unaudited Financial Statements + Tax S$800

- Full XBRL S$500

- Consolidated Unaudited report S$1,000

- GST Registration S$300

- Payroll, per person S$25/m

Your financial data protected

We set up a direct connection with Xero and your bank to exchange your data securely. All your documents will always be in one place protected with bank-level encryption

Additional things

you may need

One-off services upon your request

S$25 a month

Multicurrency Accounting

When your company deals with multiple currencies

S$1,000

Consolidation only

Covers the parent company + 1 subsidiary. Add subsidiaries, associates or joint ventures at S$300 each.

from S$100 a month

Bookkeeping only

Includes bookkeeping in Xero, books ready for your accountant, and online support

S$300

Dormant Accounting

Includes Unaudited Report and tax filing

S$25 per person per month

Payroll

We issue payslips, calculate basic salary, overtime, and bonus, prepare and file statutory contributions: CPF, SDL, FWL, etc.

S$200

XBRL Highlight

Only required for companies with negative equity or insolvent

S$500

Full XBRL

Mainly required for companies being audited, or companies with corporate shareholders, regardless of equity being positive or negative

S$500

Tax Filing Only

We file and submit the tax computation you have. Does not include the correction of errors.

S$150

Certificate of Residency (COR)

COR confirms residency status, it allows to reduce the withholding tax based on double tax treaties when dealing with overseas companies

S$600

Form C

Preparation and filing

Our clients know best

89% of customers recommend us

7,500+ clients worldwide

Here’s what our customers say

Q&A

What is XBRL and its benefits?

Created in 1998, XBRL software is managed by a global not-for-profit consortium, XBRL International. And can defined simply as a standardized language that is used to make reports easier to understand and compare. XBRL provides

- Clear definitions called XBRL taxonomies that clarify the meaning of all reporting terms used in business reports.

- Multi-lingual support

- Testable business rules that allow users (such as businesses or governments) to flag specific criteria.

Benefits of XBRL filing software

- Saves time spent by accountants and analysts on reformatting information and trying to understand different sources

- Reduces cost and manpower spent on understanding financial information

- Improves access to financial information

- Improves data quality and validity of information

What is XBRL Singapore requirement for businesses?

Financial reports filing in XBRL format is compulsory for most businesses in Singapore. All companies incorporated in Singapore (whether limited by shares or unlimited) – unless exempt - must file their financial statements with ACRA in XBRL format.

To understand their compliance requirements, companies need to first find out if they qualify for filing a full XBRL report or XBRL highlights or PDF reports.

What are Full XBRL and XBRL highlights?

Not every company needs to file a full set of XBRL in Singapore. In some cases, some financial highlights in XBRL format, with a PDF of the financial statements tabled at the AGM, are enough. According to ACRA, these XBRL highlights must contain 50 data elements that provide the most relevant company information.

On the other hand, a full set of XBRL in Singapore consists of the following information for the last financial year –

- Statement of financial position

- Statement of profit or loss

- Changes in equity

- Cash flow

- Financial notes or comparative information

Full XBRL XBRL highlights & PDF copy Full XBRL or PDF copy & XBRL highlights Exempt Only PDF copy Public/private companies (limited or unlimited by shares) Commercial bank, merchant bank, registered insurer or a finance company regulated by the Monetary Authority of Singapore Insolvent EPCs Solvent Exempt Private Companies (EPCs) - but they are encouraged to file full XBRL or highlights. Companies limited by guarantee Companies permitted to use accounting standards other than SFRS, SFRS for Small Entities, and IFRS Limited partnership, Partnership or sole proprietorship Foreign companies, or local branches of foreign companies Dormant companies that fall under Section 201A of the Singapore Companies’ Act.