Financial reporting in Singapore

We explain the standards for financial reporting in Singapore and help small and medium businesses organise stress-free accounting

Learn what it takes- FA20170653

- Xero Platinum Partner

- Our accountants are certified by ISCA

- License No. 19S9930

- Pioneers of Cloud Community Network

What are the financial reporting standards in Singapore?

Singapore Financial Reporting Standards (SFRS) – have been mandatory for all companies in Singapore since 2003. They are based on the International Financial Reporting Standards (IFRS). In general, the SFRS is a useful tool to understand the financial standing of a company and is widely used by investors, lenders, and similar stakeholders to estimate the value of a business.

What Is Financial Reporting In Singapore Used For?

In Singapore, the Accounting Standards Council (ASC) is responsible for establishing and regulating financial reporting procedures.

These include:

- SFRS (International)

- Financial Reporting Standards (FRS)

- SFRS for Small Entities

All in all, the entire codex of accounting standards contains around 41 standards. Each standard handles a different topic such as financial statements, accounting for inventories, and so on.

How do I set up financial reporting for my Singapore business?

Keeping track of the entire set of standards is quite complicated, expensive, and time-consuming for small or medium-sized firms. That’s why in 2009 the Singapore Accounting Standards for Small Entities has been proesented as an optional framework for SMEs. The SFRS for Small Entities allows SMEs to stay compliant while ensuring transparency and comparability needed by investors and the government.

Businesses can transition from full SFRS to SFRS for Small entries anytime provided they meet the criteria laid down by ASC or if full SFRS doesn’t serve their company’s future plans or current needs. Regardless of what you choose as your financial reporting order, you would need to bring in experts trained in financial reporting from ACCA (the Association of Chartered Certified Accountants) in Singapore or outsource to SFRS experts in accounting firms.

We provide hassle-free financial reporting

We take over the paperwork routine, file reports, and give active advice. Our accounting and financial reporting comes at a flat monthly fee, so no extra charges out of the blue.

Get StartedAccounting plans that match

the size of your business

You don’t measure your business by the number of transactions, so neither do we. Our accounting packages are tied to your revenues. Pick a monthly plan to receive regular financials, or an end-of-the-year catch-up accounting to submit neat reports. All our packages come as they are, no extra charges — simple and straightforward.

Need more?

Additional services you may need

Get more- Multicurrency accounting S$200/y

- Dormant Accounting S$300

- Unaudited Financial Statements + Tax S$800

- Full XBRL S$500

- Consolidated Unaudited report S$1,000

- GST Registration S$300

- Payroll, per person S$25/m

Our clients know best

89% of customers recommend us

7,500+ clients worldwide

Here’s what our customers say

Q&A

What is financial reporting?

World over financial reporting procedures are used to understand the financial activities and position of a business, an entity, or a person. This is done under the stringent regulations of the country (in Singapore, Singapore Financial Reporting Standards (SFRS) by the Accounting Standards Council is the governing law), which dictates how business information such as tax or financial reports are maintained and presented.

What is an accounting report of a company?

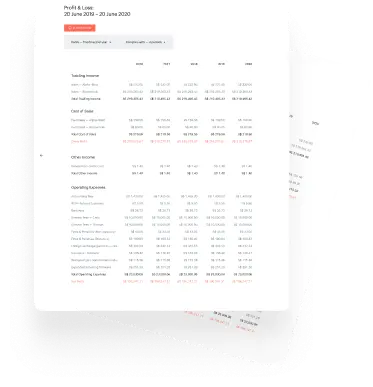

Accounting reports of a company comprise its financial reports. These can be either templated regulatory reports required under the law or custom-made documents created to present information for a specific purpose, such as the profitability of a particular product item.

Most businesses in Singapore would be required to prepare accounting reports such as cash flow statements, profit and loss statements, balance sheets, etc.

What is financial reporting in accounting?

In accounting, financial reporting usually refers to documents that are used or are required to show the financial health of a company to outsiders such as investors, creditors, or banks. These usually comprise materials such as income statements, balance sheets, quarterly earnings, and annual reports to stockholders or documents about stocks and other securities.

Financial reporting facilitates decisions like credit or lending to the company, investments, or for determining taxation.

How to do financial reporting?

Financial reporting is a powerful tool for imparting key financial information about the company to both in-house management and external stakeholders. To keep a tight grasp on the functioning of the business, daily, weekly, or monthly financial reports can be added to the usual quarterly or annual documents. The most common of these are the balance sheet, income statement, and cash flow statement.

What are the different types of financial reporting?

Financial reports include four main types of documents –

- Balance sheet - provides information about a company’s assets and liabilities.

- Income statement –shows how much revenue a company earned over a time period.

- Cash flow statements – show inflows and outflows of cash.

- Statement of shareholders’ equity – reports the interests of the company’s shareholders.

What is the purpose of financial reporting?

The core function of financial reporting is to give a comparable overview and an in-depth understanding of a business’s financial health. These reports are used to make key financial decisions by senior management and are also used by external investors, banks, and creditors for determining a company’s financial position.