Hassle-free

accounting for your e-commerce

We convert statements from e-commerce platforms into books, give you accounting services, tax filings, and profitability reports

Tired of dealing with accounting documents? We make it easy

E-commerce expertise

Processing refunds in US Dollars from your Indonesian shop with a supplier in China? We’ve done that. Selling via PayNow on Lazada and Shopee? Sure! Whatever question you may have, we will take care of your query, as we are experts at your command.

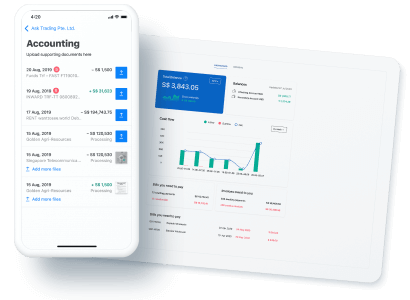

No-sweat accounting

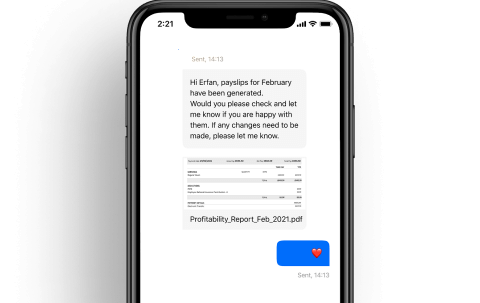

Connect your Shopee, Lazada or any other platform in just 2 minutes. We convert their statements into books and produce reports and tax returns. A Chartered Accountant assigned to your company will track filing deadlines, suggest tax exemptions, and prepare reports.

Numbers to grow your business

We consolidate numbers for each SKU, product group, and market, so you can see which category or item brings the most revenue in the profitability report.

Here’s how East river takes care of your accounting

Connect

with one clickConnecting your e-commerce platform to East river takes 2 minutes. We then upload all the documents automatically, so there’s less work for you.

We organise

documentsWe go through documents and transactions, match them, tag accounts, and tell you what’s missing. It protects your reports from any mistakes.

We file reports

on timeWe make sure you get all the reliefs and exemptions available. You review and e-sign ready reports. We then send them to the authorities.

Trusted by e-commerce sellers worldwide

89% of customers recommend us

7,500+ clients worldwide

Here’s what our customers say

Accounting plans that match

the size of your business

You don’t measure your business by the number of transactions, so neither do we. Our accounting packages are tied to your revenues. Pick a monthly plan to receive regular financials, or an end-of-the-year catch-up accounting to submit neat reports. All our packages come as they are, no extra charges — simple and straightforward.

What’s your average monthly ?

Need more?

Additional services you may need

Get more- Additional sales channel S$25/m

- GST registration S$300

- Profitability report by sales group/channel S$200/m

- GST preparation and filing fee S$300 per quarter

- Multicurrency accounting S$200/y

- Tax computation and filing S$500

- Full XBRL S$500

- Unaudited Financial Statements + Tax S$800

- Consolidated Unaudited report S$800

- Tax Consultation from S$100

We do reporting & tax filing for multiple e-commerce platforms

Shopee statements have 150+ types of fees and charges. Lazada sends their financials in its own time frame and fashion. Stripe dumps receipts from your website in a different format altogether. We handle them all.

- FA20170653

- Xero Platinum Partner

- Our accountants are certified by ISCA

- License No. 19S9930

- Pioneers of Cloud Community Network

Q&A

What is e-commerce accounting?

The definition of e-commerce accounting is reporting about your e-commerce business financials to the government. As an online vendor, you move products in and out, manage stock, and sell to customers in different countries via different channels. So, there are several things your e-commerce accounting includes:

- Bookkeeping, which lists every transaction. For example, when you accept products to your storage, or sell on Amazon, or have to accept back a pair of shoes on ebay. Bookkeeping keeps track of every money or asset movement, and provides a document covering every such event.

- Management reports, which gather all the sales data and try to make sense of it. For example, how much of each product you sold, what are the costs of operating every channel, and where do you actually make money.

- Tax filing & statutory reports. These depend on where you sell, for each government has a different tax system. Tax reports constitute a very detailed recount of every transaction and the categories they fall under. Depending on the categories, different types of tax are derived. An experienced accountant can also help make sure you get the benefits and exemptions available to your business under each specific tax code.

How do I start an e-commerce business account?

When organising accounting for ecommerce sales you need to make sure that you have all your needs covered.

- All your channels. Do you sell via different platforms? You need a way to consolidate reports from various sources

- All your tax jurisdictions. Do you sell in more than one country? You need to report for VAT everywhere you make money

- No manual paperwork. Processing invoices and receipts is tiresome, and you probably have better ways to spend your time than that.

How do I record sales in Shopify Xero?

Xero is a bookkeeping software we use. If you operate it yourself you‘ll have to manually go to Xero, choose ‘Accounts’ tab and press ‘reconcile’ each time. We connect your Shopfiy (Amazon, ebay, you name it) account directly and upload data every 24 hours. By the way, East river is Xero’s platinum partner.

How do I record online sales on Amazon?

The best way to track online sales on Amazon is to connect directly to a bookkeeping software. We use Xero, there’s also Quickbooks, Sage and others. We connect the feed automatically and switch you to Xero seamlessly if needed. After that, any time you receive a statement from Amazon, it will automatically appear in Xero, where we take it, sort it into categories, tag, and deliver up-to-date financials daily.