Stress-free Accounting for your Amazon business

We help Amazon sellers get accounting off their chest with a service tailored to suit e-commerce businesses

- FA20170653

- Xero Platinum Partner

- Our accountants are certified by ISCA

- License No. 19S9930

- Pioneers of Cloud Community Network

Accounting solution tailored for Amazon sellers

We reconcile FBA transactions

We connect you to Xero and A2X, upload Amazon financial statements directly from your account, convert them into books

We prepare and file reports for your Amazon shop

We prepare and submit all the necessary financials: ECI, Form C / C-S, and tax return. We also provide management reports and at a small monthly fee profitability breakdowns by SKU, category & platform.

We sync accounting for all your sales platforms

Add Shopify, Qoo10, Lazada, Shopee or any other marketplace to your accounting plan and get joint reporting for a small fixed fee

Here’s how East river makes accounting stress-free for your Amazon shop

A personal accountant

A Chartered Accountant assigned to your company will track filing deadlines, suggest tax exemptions, and prepare reports

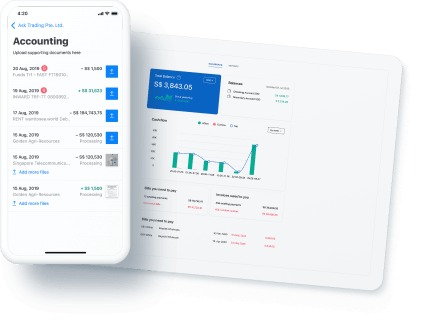

Zero paperwork

We upload statements automatically, integrate with Xero and A2X, send you docs to sign electronically, and e-file reports neatly and on time

From desktop or mobile

Access East river easily on the go to review numbers, confirm reports and get answers fast in a chat

Get StartedCheck our accounting services for other e-commerce platforms in Singapore:

Accounting plans that match

the size of your business

You don’t measure your business by the number of transactions, so neither do we. Our accounting packages are tied to your revenues. Pick a monthly plan to receive regular financials, or an end-of-the-year catch-up accounting to submit neat reports. All our packages come as they are, no extra charges — simple and straightforward.

What’s your average monthly ?

Need more?

Additional services you may need

Get more- Additional sales channel S$25/m

- GST registration S$300

- Profitability report by sales group/channel S$200/m

- GST preparation and filing fee S$300 per quarter

- Multicurrency accounting S$200/y

- Tax computation and filing S$500

- Full XBRL S$500

- Unaudited Financial Statements + Tax S$800

- Consolidated Unaudited report S$800

- Tax Consultation from S$100

Our clients know best

89% of customers recommend us

7,500+ clients worldwide

Here’s what our customers say

Q&A

What accounting software does Amazon use?

Accounting for Amazon usually runs on two main software solutions: Xero and A2X. A2X organises all your transactions and sends them to Xero. Xero matches them to your bank transactions and provides neat books. This way your sales numbers and bank balance always match. At East river, we connect to both A2X and Xero. We then take over the organised books, and convert them into accounting reports: management report, tax returns, and profitability breakdowns.

How does Amazon do accounting?

Accounting for Amazon FBA sellers is a crucial part of business, if a bit boring. The most important thing is that every transaction, that is, any time money goes in or out, is accounted for. Amazon generates statements to reflect what you sold or reimbursed, but those do not yet qualify for bookkeeping and accounting. You have to break those statements into single transactions with relevant tax tags and match them to statements from your banks. Then you can create reports: for your management purposes (P&L, profitability, etc), and the ones you have to file for government purposes (Estimated Chargeable Income, Tax returns).

You don’t have to do it yourself (in fact, it’s probably best that you don’t). We can build these Amazon accounting services for you in a way that doesn’t demand much of your time and costs reasonably.

We upload Amazon statements, convert them into neat books using A2X and Xero, and then prepare reports. We submit government filings neatly and on time, so no nasty fines there.

How do I connect Amazon to Xero?

Xero is probably the best accounting software for Amazon FBA, and it’s quite easy to connect. If you sign up to East river, the connection takes less than a minute: you simply go to your settings and choose “Connect to Xero”. We also provide it for free as part of our Amazon accounting services.

Which accounting firm audits Amazon?

Amazon uses the services of Ernst & Young (EY), an accountancy giant that has been auditing them even before the 1997 IPO. When it comes to accounting for Amazon sellers, however, this company might be way too big and expensive to hire. While choosing your accountant, make sure they specialise in e-commerce accounting, and are especially familiar with the marketplaces you use. Also check the way they build their plans. Avoid being charged by transaction volume, as you may have multiple tiny sales. It makes better sense for Amazon sellers to be charged based on the revenue.