Contra Account

A Contra account balances out associated accounts in the general ledger. If the main account is recorded as a debit, its contra account is a credit and vice versa. If you wish to keep everything in order, trust us to do your bookkeeping and accounting duties, and we will bring the balance to your business papers.

In bookkeeping, contra accounts are often used to make adjustments for potential losses like depreciation or loss in value.

Imagine you bought an expensive computer screen. There is an asset account in your books indicating how much your monitor costs. Over time, it will depreciate. Your screen is getting cheaper over time, so you are steadily losing money on it. That is the opposite of possessing an expensive asset, so you record it in the account opposite the asset in the so-called accumulated depreciation account. These two balance each other, making the accumulated depreciation account contra to the assets account.

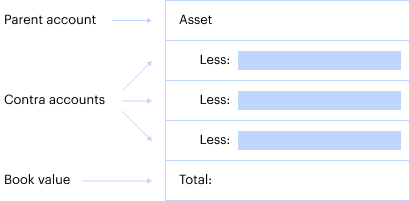

In the balance sheet, contra accounts are recorded right under its counterpart and look something like this:

Why have separate accounts?

Contra accounts make your books cleaner. For example, instead of changing your screen value in the asset account as this asset ages, you just have an accumulated depreciation account that increases over time.

Contra accounts make your books easier to maintain because you don’t have to manually adjust every entry as its value changes. Leaving the main account on top unchanged, you just add more and more lines with contras as the value changes:

With contra accounts, you can easily find the book value of your assets, i.e. the sum you could sell each asset for at a certain moment of time.

For example, an oven in a bakery is an asset that has contra accounts which indicate what reduces the original value. It looks like this:

Subtracting all the contras from the original cost of an asset, you get its book value — its cost balanced with depreciation and other contras.

Looking at the book value of an asset, you clearly see the right moment to replace it. The value of the oven is now very close to its contras — depreciation and impairment losses.

How to use contra accounts

Under Accrual Accounting, it is possible to make a mistake when recording profit. It is natural to sometimes be wrong about the future and make a mistake predicting it in the books. To adjust for that, it is convenient to have a contra account for sales. The two most popular ways of doing that are:

- Fixed allowances for the money you won’t be able to collect;

- Percentages for the same thing.

In retail, for example, it is a good idea to have a contra account that adjusts your potential profits for a part of the inventory that goes unsold. An item (good) can be returned by the customer, be defective, or simply remain unsold.

In some specific cases of retail (like groceries), it is a good idea to make a contra for the obsolete inventory that balances your profits in sales. These apples might turn into cider in the right circumstances, but before they do — they are a loss.

| Inventory sold | £1,000,000 |

| Less: Obsolete inventory | £3,000 |

| Less: Customer refunds | £5,000 |

| Less: Inventory not sold | £20,000 |

| Net profit | £972,000 |

How not to use contra accounts

Much of this section applies to accrual accounting in general.

You don’t always need contra accounts. It only makes sense to have one if it helps you understand your financial position better by providing you with useful information about the state of your accounts.

If you are not certain whether you will need to deduct something from your account, it is better not to make any contra to it, especially if you have already set aside some funds in provisions to cover for potentially unforeseen expenses.

Here is a bad example of a contra account as it doesn’t relate to the main account:

| Office computers | £100,000 |

| Less: Microsoft Office subscription | £4,000 |

Microsoft Office is a very important expense for many companies around the world. It does have to be installed on computers, but the computers’ value doesn’t decrease because of it. Neither does it increase as you certainly can’t sell the computer with your corporate pre-installed software. It makes no sense to have this Contra Account in the books.

To sum up

- Contra accounts balance entries in your general ledger.

- The difference between the main account and its contra accounts is the book value of an asset.

- You need contra accounts to better understand the financial position of your business.

Starting a new business in the UK? We will do all the work for you.