Hong Kong Withholding Tax: What Is It and Who Pays It?

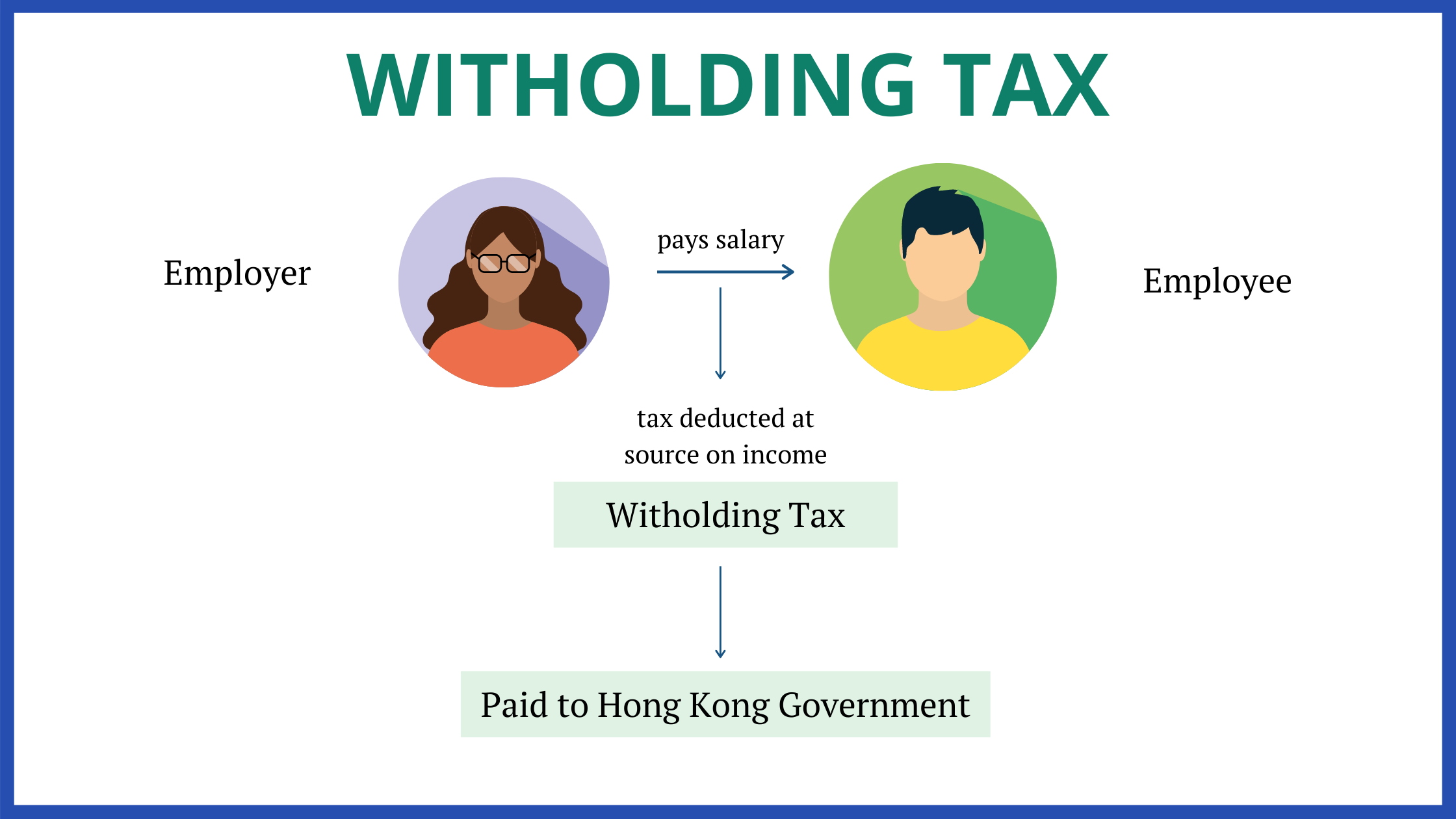

Withholding tax (WHT) is a certain amount of payment which must be withheld and paid to IRD and applicable only to Hong Kong non-residents.

Rules, regulations and responsibilities. Three small words that play a big role in the life of an entrepreneur like you. When it comes to tax and accounting in Hong Kong, you don’t need to be an expert but it is important that you’re aware of concepts that will apply to you as a business owner in Hong Kong. Withholding tax is one of them.

What Is Withholding Tax?

Before we unpack the meaning of withholding tax in Hong Kong by diving into the necessary nitty-gritty details, let’s start with some fundamentals:

● Any non-resident - whether a company or an individual - who earns an income from a source in Hong Kong is responsible for paying tax on the profits they make.

● The company or individual who pays that non-resident for their services or the work they do withholds a portion of that payment. That withheld bit? That goes to the Hong Kong Inland Revenue Department. That percentage is what is referred to as withholding tax.

What is a territorial tax system?

This means profit tax is only applied to the income that comes from a source within a specific territory. In this case, that’s Hong Kong.

Who Does WHT in Hong Kong Apply to?

We’ve already covered that withholding tax in Hong Kong applies to companies or individuals that are non-residents, but what exactly does this term mean? On an individual basis, a non-resident is a foreigner who’s lived and worked in Hong Kong for less than 180 days in a tax year. They’re liable for taxes according to the territorial system of tax we mentioned above. This specific tax is levied on any profit that’s earned as a result of the trade, profession or business that’s run in Hong Kong.

Withholding tax applies to companies in the same way. Any company that is incorporated outside of Hong Kong, or has its central management and control outside of this jurisdiction are also considered to be non-residents. The bottom line is that if this business entity earns a profit that comes from a source in Hong Kong, they’re liable for withholding tax.

What Payments Are Subject to Withholding Taxes?

Withholding tax only applies to specific payments, which include royalties or license fees as well as payments made to entertainers and sportspeople who are non-residents. Let’s take a closer look.

Royalty Payments

Usually relating to intellectual property, royalty payments can include everything from payment for the use of patents and trademarked material to sound, TV and even film recordings. The exact amount depends on whether the non-residents who’re receiving that royalty are associates or non-affiliates of a Hong Kong company.

Here’s how withholding tax percentages apply to royalty payments in different instances:

Tax rate of 15%: Applied to payments made to non-resident individuals that come from an associate in Hong Kong.

Tax rate of 16.5%: Applied to payments made to a non-resident company that come from an associate in Hong Kong.

Tax rate of 4.5%: Applied to payments made to non-resident individuals that don’t come from an associate in Hong Kong. This is the effective tax rate.

Tax rate of 4.95%: Applied to payments made to non-resident companies that don't come from an associate in Hong Kong.

Defining an “Associate”:

This term can apply to people, corporations and partnerships. In the case of withholding taxes, it broadly encompasses an entity or a person who shares an active involvement, connection or link to the control of a Hong Kong company. This is unpacked in more detail by the Inland Revenue Ordinance of Hong Kong which you can read here.

Sportspeople or Entertainer Payments

The amount of withholding tax applied when it comes to payments made to sportspeople or entertainers in Hong Kong also varies. It all depends on what goes down when an agreement is made (and who’s involved).

Tax rate of 10%: Applied when an agreement is made directly with the non-resident or the agent who is an individual.

Tax rate of 11%: Applied when an agreement is made with an agent which is a corporation.

Are There Any Exemptions to WHT?

As an entrepreneur, it’s always a good idea to know the rules and an even better idea to know when there are exceptions to those rules. In this case, the interest and dividends that are paid to non-residents are not subjected to withholding tax in Hong Kong.

Withholding Tax Percentages by Country

Hong Kong has agreements with 30+ countries, each with its own treaty and specific conditions when it comes to withholding tax and the rates that apply. To give you an idea, here are 8 of them.

| Country | Withholding Tax Percentage |

| China | 2.475% - 4.95% |

| India | 2.475% - 4.95% |

| Canada | 2.475% - 4.95% |

| Japan | 2.475% - 4.95% |

| Vietnam | 2.475% - 4.95% |

| Korea | 2.475% - 4.95% |

| Pakistan | 2.475% - 4.95% |

| Qatar | 2.475% - 4.95% |

Wondering why those percentages range? It’s all about two-tier profit tax rates. This means that the withholding tax rate is lower (2.475%) for the first HK$2 million of profit and that it goes up (to 4.95%) when the profit made exceeds that amount.

How to Reduce Withholding Tax in Hong Kong?

Double Taxation Treaties in Hong Kong

Double taxation occurs when a taxpayer is charged twice on the same income item by more than one tax jurisdiction. To prevent double taxation, the Double Tax Agreement (DTA) was created as an agreement between two countries.

Hong Kong has signed comprehensive DTAs with more than 40 countries to reduce the withholding tax.

Tip

Click here to find the full list of DTAs

Every tax treaty specifies the conditions for withholding tax between Hong Kong and the treaty country.

The Role of DTAs

DTAs play an essential role:

- Restrain double taxation

- Strengthen connections between HK and other global tax authorities

Benefits of Double Tax Agreements

DTAs offer the following benefits:

- Tax treaties help taxpayers in one country to determine the potential tax liabilities they may have in the other country.

- DTAs provide tax relief for overseas taxes paid.

- DTAs strengthen the transparency of a country’s tax system and stop tax evasion as revenue authorities exchange information.

- DTAs’ rules make clear how the revenue of two countries is split between them. Basically, DTAs clarify the authority of transnational trade.

Who Can Claim DTAs?

You can benefit from DTAs if you are a Hong Kong resident individual. Your company must be Hong Kong registered and managed in HK too.

| Your company is a resident of HK if: | You are a HK resident individual if: |

|---|---|

|

|

Double Tax Relief Methods in HK

How you can relieve double taxation relies either on domestic taxation laws or a certain DTA.

There are four common ways to relieve Double Taxation:

- Deduction of taxes: Domestic tax is applicable after withdrawing foreign tax

- Relief of tax credit: The tax paid in the jurisdiction where the income comes from

- Exemption of taxes: Foreign income is exempt from domestic taxation.Reduction of tax rate: Revenue is taxed at a lower rate and is typically applied to interest, dividends and royalties.

- Reduction of tax rate: Revenue is taxed at a lower rate and is typically applied to interest, dividends and royalties.

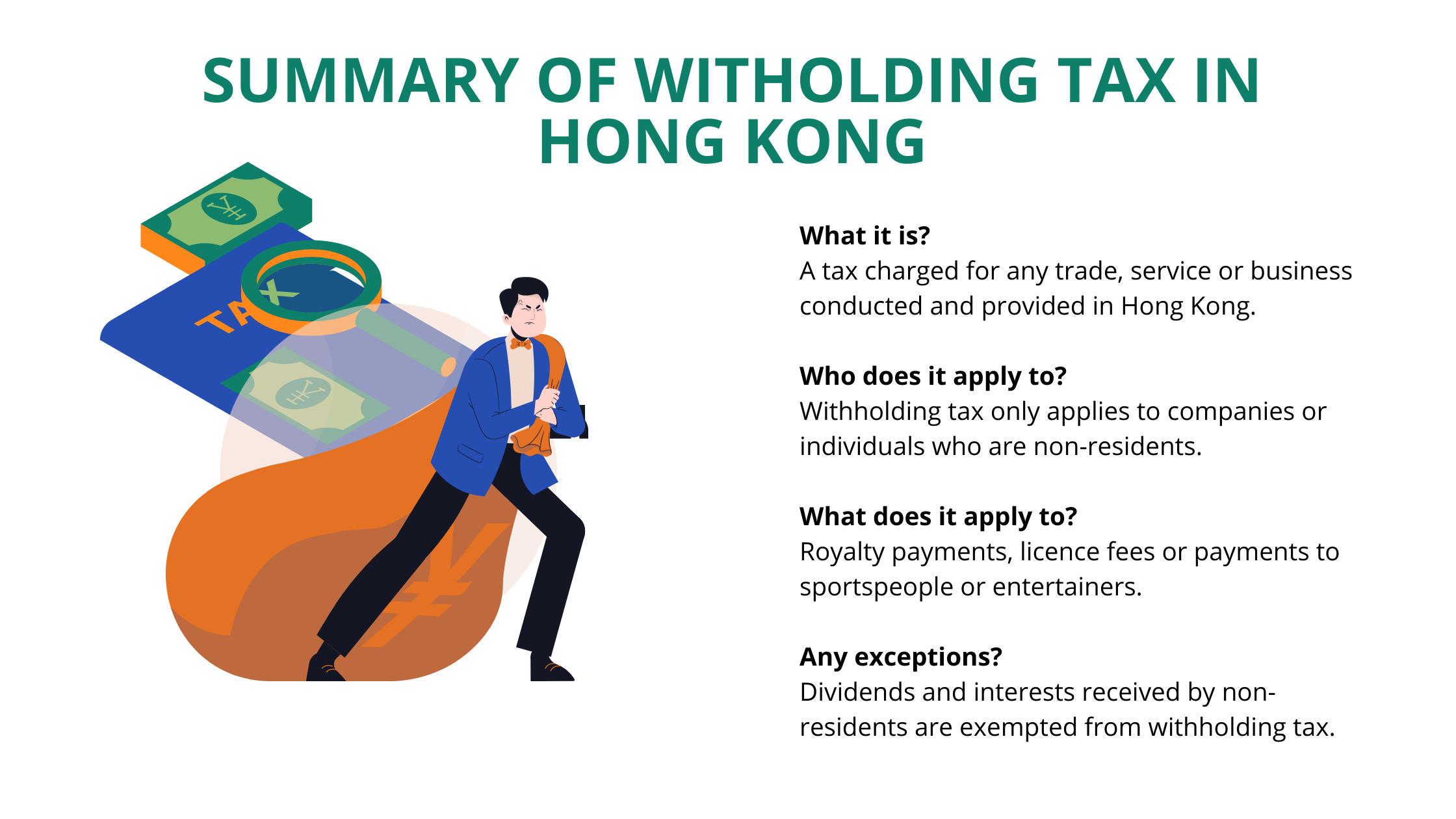

A Summary of HK Withholding Tax

So in a nutshell, here's what you need to know about Hong Kong WHT:

● What it is: A tax charged for any trade, service or business conducted and provided in Hong Kong.

● Who it applies to: Withholding tax only applies to companies or individuals who are non-residents.

● What it applies to: Royalty payments, licence fees or payments to sportspeople or entertainers.

● Exceptions: Dividends and interests received by non-residents are exempted from withholding tax.

Got any questions?

We’ve got answers. All you need to do is drop us a question here and we’ll get back to you with the info you’re after. We make it our business to support business owners like you.