Every industry has its own perks and complications when it comes to bookkeeping and accounting. We advise what tax exemptions and tax reliefs your company is entitled to, and we will organise your reports exactly the way needed to comply.

Multi-currency accounting in Hong Kong

We explain to set up a multi-currency bank account, build a multi-currency accounting system, and integrate it with Xero multi-currency accounting software

- Xero Platinum Partner

- TC006825

- Certified Public Accountants

- Chartered Secretaries

What is a multi-currency accounting system?

If you receive and send payments in other currencies than Hong Kong dollar, you need a multi-currency bank account. You then need to report for these transactions just as you do for all the others. A multi-currency accounting system records transactions in foreign currencies, adds them to financial statements and tax reports.

What are the multi-currency accounting standards?

The key part of multi-currency accounting is to show what the transaction was worth in base currency (that is, HKD) at the time it transpired. That’s why your invoices would usually show both: the foreign currency and its Hong Kong dollars equivalent.

What do I need for multi-currency accounting?

To set up multi-currency accounting, you’ll need:

- A multi-currency bank account. Make sure they process payments quickly and without high currency exchange fees.

- Bookkeeping platform to manage paperwork, Xero multi-currency accounting software being the most popular one.

- An accountant who has experience managing multiple currencies to put together reports and statements. Alternatively you can do it yourself if you have time and know what to do.

We provide hassle-free multi-currency accounting

We take over the paperwork routine, file reports, and give active advice. Our multi-currency accounting comes at a flat monthly fee, so no extra charges out of the blue.

I want to try

You get a personal accountant

A Chartered Accountant assigned to your company will track filing deadlines, suggest tax exemptions, and prepare reports.

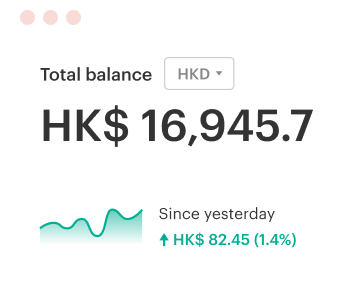

You see how much money you have

We show totals from all your multiple currency accounts in Hong Kong dollars.

Accounting plans that match

the size of your business

You don’t measure your business by the number of transactions, so neither do we. Our accounting packages are tied to your revenues. Pick a monthly plan to pay a small regular fee or a yearly one and get 2 months free of charge. All our packages come as they are, no extra charges — simple and straightforward

What’s your average monthly ?

Profits Tax Return, (BIR51) filing

HK$1,000

Consolidated unaudited report, per subsidiary

HK$5,000

Holdover of provisional profits tax application

HK$2,000

Application for Offshore tax exemption

from HK$10,000

Your financial data protected

We set up a direct connection with Xero and your bank to exchange your data securely. All your documents will always be in one place protected with bank-level encryption

Additional things

you may need

One-off services upon your request

HK$2,000 per year

Audit liasing

We help with the audit you need to pass every year

HK$5,000 per subsidiary

Consolidated unaudited report

Something here

HK$1,000 per return

Profits tax return (BIR51) filing

For nil profits or a Dormant company

HK$2,000 per application

Holdover of provisional profits tax application

For clients using Accounting services

from HK$10,000

Offshore profits tax exemption

We handle replying to questions regarding your company’s qualification.

We calculate the fee for each case individually

Our clients know best

89% of customers recommend us

7,500+ clients worldwide

Here’s what our customers say

Q&A

What is a multi-currency accounting system?

A multi-currency accounting system refers to an accounting system, often an online accounting software, which handles an organisation’s transactions across multiple currencies. It is used for companies that receive or pay amounts in currencies apart from the base monetary denomination used in the country they operate from.

For example, in Hong Kong, a business might have clients in the US or Europe or countries in Asia. Each would transact in their own currency while the company is incorporated in Hong Kong and pays taxes in Hong Kong dollars. A multi-currency accounting system would automatically calculate exchange rates and present all the information in local currency.

Why do I need multi-currency accounting?

If you are a business operating in Hong Kong, then ten to the one you are dealing with several currencies. Hong Kong is a melting pot of companies and entrepreneurs from all over the world. Naturally, money from trading partners and customers flows in and out in a bewildering range of currencies – making accounting complex and extracting reports and insights even tougher.

So if you plan to run your business across nations and manage business transactions in diverse currencies, then you will certainly need a multi-currency accounting system and a multi-currency bank account.

How does multi-currency accounting work with you?

With us, you get Xero-powered East river platform and a personal accountant. Xero’s multi-currency accounting software allows businesses to add a base currency and specify the country where they file their taxes. The rest of the system is set up automatically. After that, you can add as many as 160 different currencies. The exchange rates are updated every hour automatically, and all transactions are converted and presented in the local currency in real-time.

At East river, we regularly use multi-currency accounting software such as Xero to manage our clients’ financial needs. We process your invoices and receipts, prepare financial statements and management reports, file taxes and come up with exemptions and reliefs for your business.

Does Xero’s online accounting software handle multiple currencies?

Yes, Xero, which is one of the most widely used accounting software, has a multi-currency accounting feature. The software can handle up to 160 currencies and allows clients to add even more. The software automatically calculates the latest exchange rates (this is updated hourly) and gives businesses a real-time view of their cash flow.

Is it possible for me to hold foreign currency in my business bank account?

To transact in foreign currency, you need foreign currency or a multi-currency account. In Hong Kong, many local and global banks offer this facility.

A multi-currency account allows businesses to transact without paying steep exchange rates and reduce the processing time. All the main banks in Hong Kong offer multi-currency accounts, which is quite a standard feature seeing how it is in a very high demand. Each bank has a slightly different offer, so it’s best to check on their individual sites for detailed information.