Filing Your Annual Return in Hong Kong: A Quick Guide

Let’s start with the important bit. Filing an annual return to Companies Registry is not a choice, it is something you need to do legally. If you own an incorporated company in Hong Kong, this quick guide will help you get up to speed on the process.

What Exactly is an Annual Return?

Every year, you need to tick the boxes of corporate compliance and pay a fee to renew your business registration certificate. This is where your annual return comes in. Think of it as something like a driving license. You need to pass some checks and only then will you be able to continue running your business legally

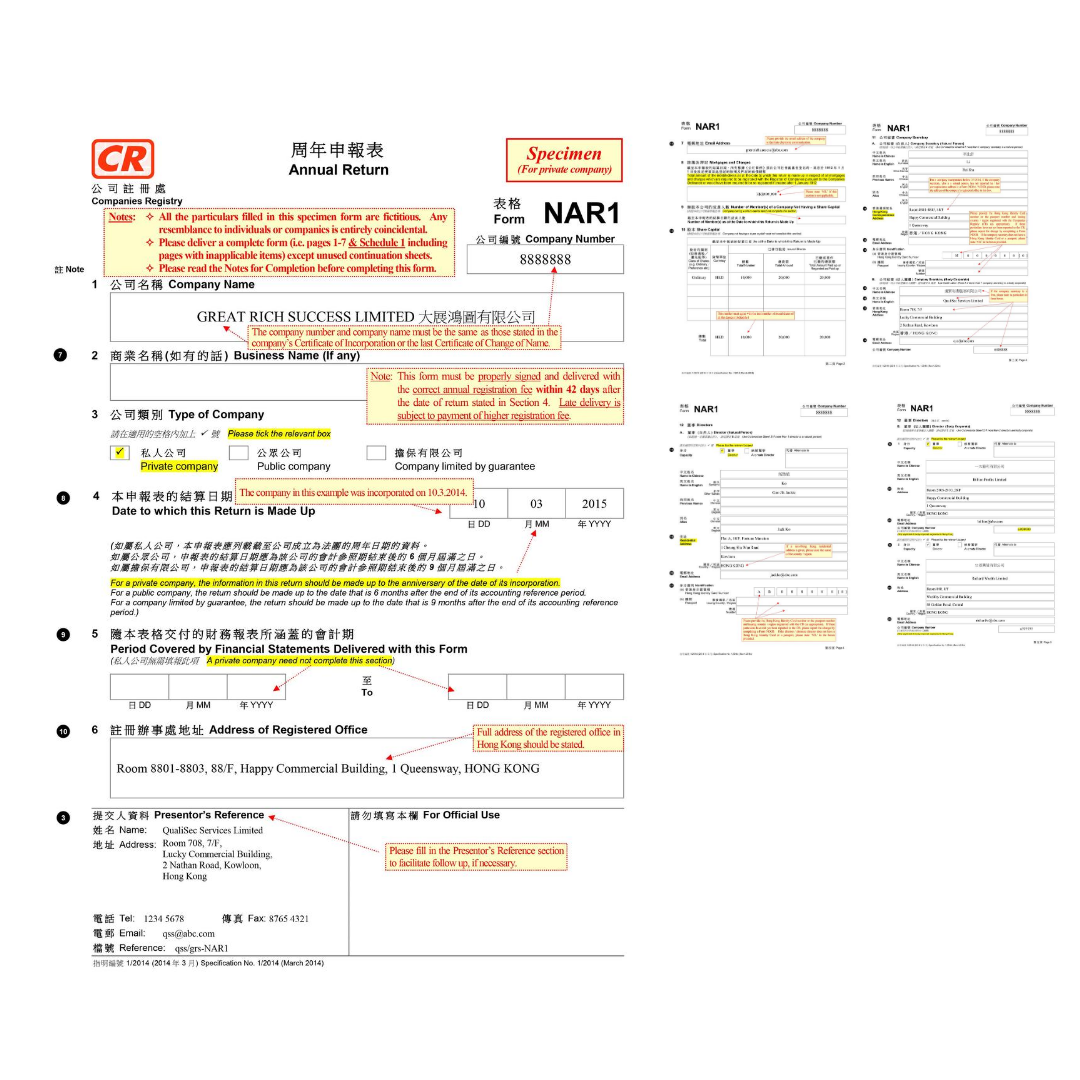

This form below (officially referred to as Form NAR1) gives the government a snapshot of the most important details about your company - covering everything from shareholder and director information, to your official registered address and overview of operations. Your annual return is prepared by your appointed Company Secretary and delivered to Companies Registry where it becomes public record.

Company Secretary: Annual Returns Made Simple

Company secretary, corporate secretary, or compliance officer. They are also your fines fighter and, penalty protector. Upon the incorporation of your company, and having your business up and running, you (and any fellow directors) need to appoint a Company Secretary in Hong Kong.

Not only do they make sure your business adheres to Hong Kong’s corporate law, but they’re also responsible for the less glamorous tasks, like documenting any operational, managerial or structural changes to your business. They’re responsible for collating, signing, certifying and submitting this information on time and are just as liable as you for the accuracy of what’s included in your annual return.

Can I switch my Secretary?

Of course. Your newly appointed Secretary will take care of the handover and keep the Companies Registry in the loop. You don’t need to lift a finger. Ask us about this.

What Date Is My Annual Return Due?

In April, you’ll get a Profit Tax Return.

The Inland Revenue Department (IRD) will issue profits tax return form to companies that are carrying out their business in Hong Kong.

The clue’s in the name. Every calendar year. Within 42 days of your company’s initial incorporation (except for the first year). Even if the fundamental information about your company hasn’t changed year-on-year, you are still required to submit the NAR1 form and pay the registration fee. Speaking of which, here are the annual fees applicable to different companies:

● Public Company: HK$140

● Company Limited by Guarantee: HK$105

● Private Company: HK$105

It’s important to submit your annual return within the allotted time frame to avoid what could end up as hefty penalties (or worse, prosecution for breaching the Companies Ordinance). The later the submission, the higher the fine you face. Take a look:

| Date of Delivery | Months Since Company Incorporation | Penalty |

| 42+ days | >3 | HK$ 870 |

| 3+ months | >6 | HK$ 1,740 |

| 6+ months | >9 | HK$ 2,610 |

| 9+ months | +9 | HK$ 3,480 |

Ways to Submit Your Annual Return

Hard Copy: If you go this route, you’ll need to download the NAR1 form and deliver a signed copy by post or in-person to the Companies Registry. This PDF provides a handy overview of the filing requirements.

Electronic Form: The Companies Registry has an electronic filing service that’s accessible 24/7. Get to know more about the e-Registry and how you can sign up for this service.

Signed, sealed, delivered

There it is. The what, why and how to go about your company annual return as a Hong Kong business owner. Remember, you’re not in this alone. If you’ve got questions, drop us a message.