How To File a Hong Kong Employers Return? Form BIR56A and IR56B

The Employer’s Return of Remuneration and Pensions (Employer’s Return) is the annual reporting of the amount of salary and all other benefits that an employee receives. As an employer of a registered company in Hong Kong, you would have to submit this document to the Inland Revenue Department.

Skip to:

What Is the Employer’s Return Form?What Is the Yearly Obligation for Employers Regarding Their Employee’s Salary?

What Should HK Employers Take Note of When Filing Employers Return?

When Do I File the Employers Return? Would Any Extension Be Granted for Employers Who Do Not File on Time?

How to File the Employers Return?

If I Am a Company Director, Do I File My Own Employers Return?

A Guide to Filing Employer’s Return for Different Types of Employees

What Is the Employer’s Return Form?

If you own a company in Hong Kong, and you already employ staff, you need to do the following:

- Keep payroll records, and

- Report how much your employees earn.

All employees’ income, regardless of where they worked (in Hong Kong or overseas) must be reported through the forms BIR56A and IR56B.

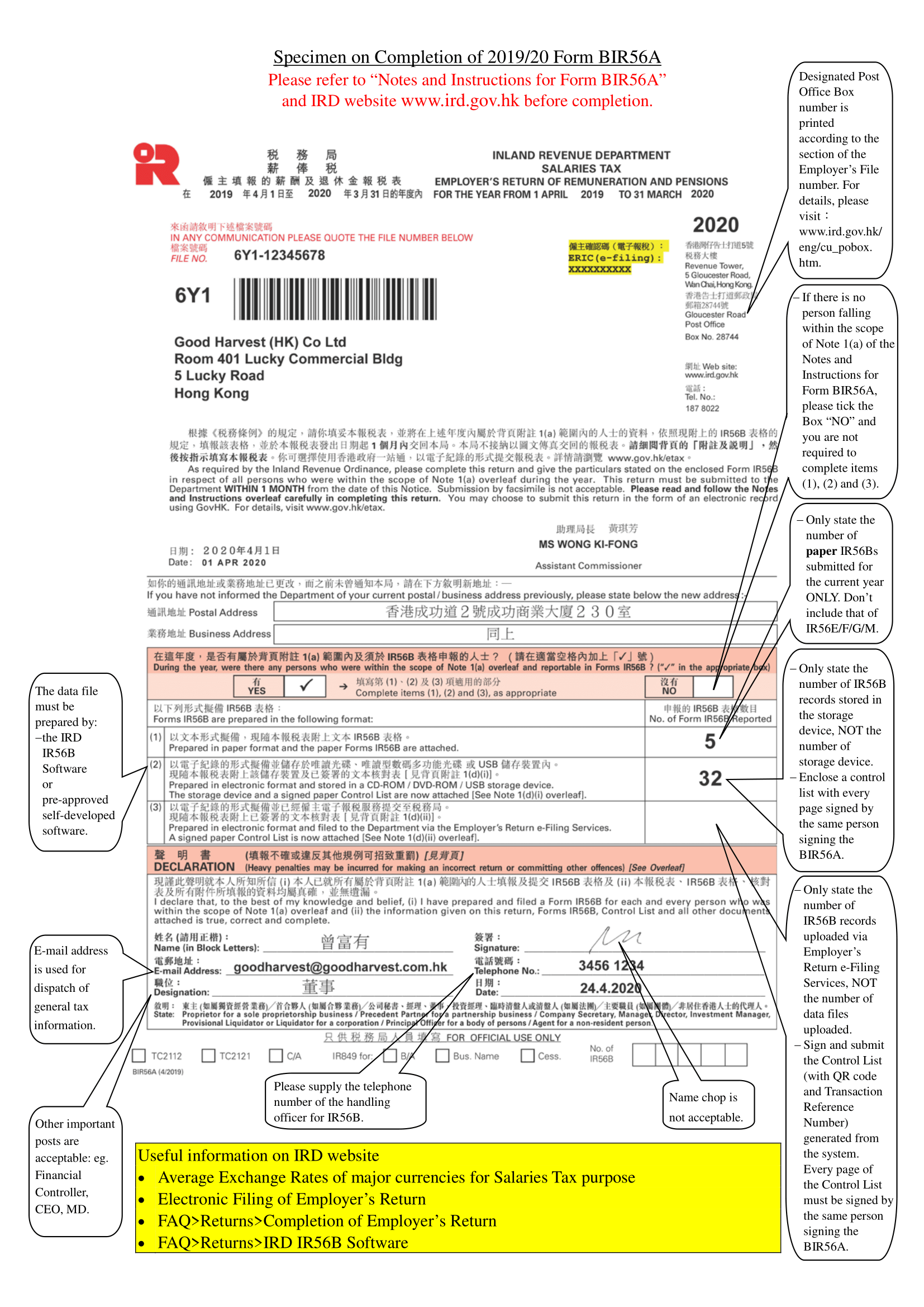

Form BIR56A is like a cover letter to all IR56B forms that an employer would submit. The number of IR56B forms that an employer submit would correspond to the number of employees he hires.

On the BIR56A form, the following information will be displayed:

- Company’s name and address

- Name of the officer who compiled the Employer’s Return

- Number of IR56B forms completed,

- Forms they were submitted and the format they were submitted on: hardcopy, online, or mixed

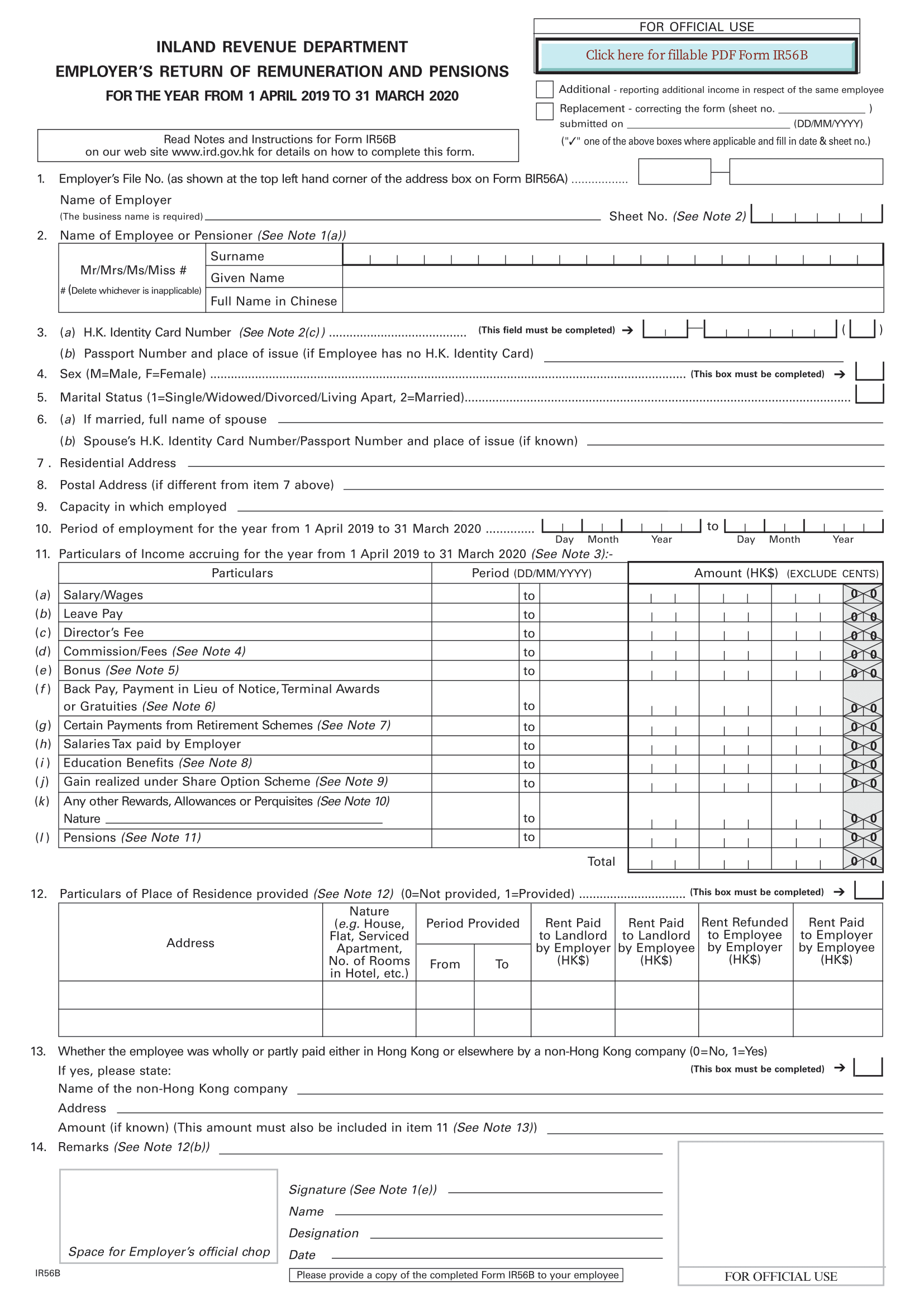

Form IR56B lists the following information:

- An employee’s personal particulars

- Position in the company

- All salary, benefits and pensions (remuneration package) they receive

What Is the Yearly Obligation for Employers Regarding Their Employee’s Salary?

The employer needs to fill in and submit forms BIR56A, and IR56B, to the Inland Revenue Department (IRD) of Hong Kong.

For the year 2021, the Employer's Return (BIR56A), together with the IR56B form, will be issued on 1st April 2021.

We wrote earlier that if you own a company in Hong Kong, and you already employ staff, you need to keep payroll records and report to the Inland Revenue Department on how much your employees earn. All employees’ income, regardless of where they worked (in Hong Kong or overseas) must be reported.

Keeping payroll records

Your duty as an employer (with regards to filing an Employer’s Return in Hong Kong) starts immediately when you hire new employees. You need to record these information from them:

- Personal particulars: Name, address, identity card or passport number with place of issue, marital status

- Nature of employment: Full-time or part-time

- Job title: e.g. sales manager, salesman, worker, in-house lawyer, accountant, director

- Amount of salary paid: Both in domestic or foreign currency; also salary given outside Hong Kong

- Non-cash or additional benefits: Such as housing or accommodation, vacation allowances, stock awards and share options

- Employer's and employee's contributions to the Mandatory Provident Fund (MPF) or its equivalent

- Employment contract and amendments to terms of employment

- Period of employment

You should keep these records for at least 7 years, and update the Inland Revenue Department accordingly if there are any changes.

Reporting how much your employees earn

To report to the IRD all earnings paid to your employees working in Hong Kong, you would need to submit the following forms:

- BIR56A and IR56B: Employer’s Return forms, as shown in the samples above

- IR56E: Form submitted when hiring a new staff

- IR56F: Form submitted when you end the contract of an employee or upon their death

- IR56G: Form submitted when an employee leaves Hong Kong for a substantial period of time or for good

The Inland Revenue Department of Hong Kong is going to send employers the BIR56A and IR56B forms (usually by hard copy but you can also submit it by e-Filing or even your company’s own filing software -with prior IRD approval) this coming 1st of April 2021.

The year of assessment for this year’s Employer’s Return would be from 1st April 2020 to 31st March 2021. Employers are required to complete and submit filled up forms to the Inland Revenue Department within one month after they are issued.

What Should HK Employers Take Note of When Filing Employers Return?

When filing an Employer’s Return, an employer needs to report the chargeable income of her employee. Chargeable income is based on whether that income or earnings, would be taxed as Salaries Tax (Income Tax) in Hong Kong.

The employee’s remuneration package (chargeable income) to be reported in form IR56B of the Employer’s Return include:

- Salaries, Wages and Director's fees;

- Commissions, Bonuses, Leave Pay, End of Contract Gratuities and Payments In Lieu of Notice accrued on or after 1 April 2020;

- Allowances, Perquisites (Benefits received because of your job position) and Fringe (Additional) Benefits -including holiday journey benefits;

- Tips received;

- Salaries Tax Paid by Employer;

- Value of a Place of Residence;

- Stock Awards and Share Options;

- Back Pay, Gratuities, Deferred Pay and Payment of Arrears;

- Termination Payments and Retirement Benefits;

- Pensions.

Ben is 67 years old, and he has been Pacific Pte. Ltd.’s Sales Manager in this year’s year of assessment. He retired on 31 December 2020, and received pension afterwards.

On his IR56B form, his employer, Jason, shall report his earnings as:

- “Salaries” from 1 April 2020 to 31 December 2020 under item 11 (a), and

- “Pension” from 1 January 2021 to 31 March 2021 under item 11 (l).

When Do I File the Employers Return? Would Any Extension Be Granted for Employers Who Do Not File on Time?

The Inland Revenue Department of Hong Kong would issue Hong Kong employers form BIR56A and form IR56B on the first working day of April each year.

Employers must complete and submit forms BIR56A and IR56B within 1 month from the date of issue.

All Hong Kong companies are issued the BIR56A and IR56B forms by the IRD, even though they do not hire any employees, have not commenced or have ceased operations during their year of assessment. They would still be required to complete and submit Form IR56B within one month from the date printed on the form.

The IRD would issue a BIR56A form to a newly incorporated Hong Kong company about 3 to 6 months after the company files its first audit.

If you need more time to prepare your IR56Bs, you could file for an extension with the IRD. Your request must be in written format and should include your company’s file number, company name, the year of assessment in question, the additional time you need and why you are applying for an extension, with supporting evidence.

How to File the Employers Return?

First, before filing your Employer’s Return, make that you have gathered all necessary payroll information of that year’s year of assessment. For this coming reporting period, that would be from 1 April 2020 to 31 March 2021, for submission on 1 April 2021 onwards (and up to a month).

Next, update each of your employee’s personal particulars if needed and determine each of their total annual remuneration.

Then, decide how you want to file your Employer’s Return. There are 3 ways:

- Both BIR56A and IR56B in physical hardcopy paper form.

Only official forms issued by the IRD, downloaded from their website (IR56B), or obtained from the Fax-A-Form Service are accepted. Wet signatures are required. It can be signed by the director, secretary, managers or liquidators.

- BIR56A in hardcopy and IR56B in softcopy.

IR56B forms in softcopy could either be on a CD-ROM, DVD-ROM, or USB storage device. You must download and use the IRD’s IR56B software to prepare it. The storage device containing the soft copy will be kept as a source document.

This method has 2 options – the online and mixed mode.

The online mode

To pay by this way, you need an eTAX (Inland Revenue Department's online services) account to which only an Authorized Signer (e.g. Sole proprietor, precedent partner, director, etc. depending on company type) can log in. This Authorized Signer has to sign and submit the Employer’s Return.

As an employer, you can choose whether to key in their employees’ information on the IR56B forms, and ‘cover letter’ form BIR56A one-by-one (Direct Keying) online, or you can also submit by uploading a data file. The advantage of submitting a data file is that it can contain up to 800 sets of IR56B forms, whereas Direct Keying’s file capacity is limited to 30 IR56B forms (however, multiple file sets could be uploaded per day).

The IRD accepts date files prepared by these methods:

- Direct Keying (all types of Employer's Return and Notifications)

- IR56 Forms Preparation Tool (Forms IR56B and IR56F)

- IRD IR56B Software (Annual Form IR56B with the submission of Employer's Return)

- Pre-approved Self-developed Software (Forms IR56B and IR56F)

Mixed Mode

This method was recently introduced in November 2018 responding to the operational needs of some employers. The difference with the online mode is that employers may submit IR56B or IR56F data files without the need to use the Authorized Signer's personal eTAX / "iAM Smart" Account. Any person appointed by the employer can upload the IR56B/IR56F data files.

When the data files are successfully uploaded, a Control List paper (with Transaction Reference Number and QR code) will be generated from the system. The Authorized Signer just needs to sign and submit the Control List paper to the IRD to complete the submission process.

If I Am a Company Director, Do I File My Own Employers Return?

Yes, a company director is considered an employee of a company. Therefore, your personal particulars and details of earnings, benefits, and allowances must be published in the Employer’s Return.

A Guide to Filing Employer’s Return for Different Types of Employees

For Employees Who Work in Hong Kong

You have to include an employee working in your Hong Kong company in your Employer's Return (BIR56A and IR 56B) for 2020/21 if he is:

- Single and paid an annual income of HKD $132,000 or more;

- Married (regardless of income)

- A part-time staff (regardless of income)

- A director (regardless of income)

For Employees who Work Overseas

Employers should include all employees whose total annual incomes equal to or exceed HKD $132,000 per year, regardless whether the employees work in Hong Kong or overseas. You may provide additional information in the remarks column (item 14 of the Form IR56B); e.g. the employee worked in the Beijing office and visited Hong Kong for less than 60 days during the entire year of assessment.

Part-timers or Freelancers

The IRD requires Hong Kong employers to report the salary packages given to full-time, part-time staff and freelancers alike. Part-time staff and their remunerations’ are disclosed in IR56B, while freelancers in IR56M, a form for remuneration paid to persons other than employees.

Terminated Employees

You have to file one copy of IR56F or via Electronic Filing of Employer's Return one month before the date of termination of his employment.

Employees Departing Hong Kong for Good

If your employee intends to depart Hong Kong indefinitely or for a substantial period of time, follow these steps

- Discuss with your employee to determine his expected date of departure.

- File two copies of IR56G or via Electronic Filing of Employer's Return one month before the expected date of departure.

- Disburse all amounts due to be paid to him (including salaries, commission, bonus, reimbursement of rent/expense, money or money's worth included) only when your employee produces IRD-issued “letter of release” after fulfilling all his tax obligations in Hong Kong.

On 5 August 2020, Evans tendered his resignation with Gem Pte. Ltd. A month later, he left Hong Kong on 5 September 2020 to move to Mexico.

Gem Pte. Ltd. should file a completed IR56G or via e-Filing in duplicate for Evans on 5 August or before 5 September 2020. It is also required to withhold all amounts due to be paid to Evans (including salaries, commission etc, money or money's worth included) from the date of filing the IR56G.

Gem Pte. Ltd. should provide Evans with a copy of IR56G and advise him to make tax clearance from the IRD prior to leaving Hong Kong.

When he pays his taxes, the IRD will issue him a “letter of release”. Gem Pte. Ltd. may release the amounts withheld to Evans when Evans produces this letter to Gem Pte. Ltd.

Note: IRD’s “letter of release" could be issued on the same day an employee pays his taxes due by cash, EPS or cashier order, in-person at Hong Kong’s Post Office payment counters at 1/F Revenue Tower. He should bring the receipt of payment to IRD's Collection Office at 7/F Revenue Tower to request for a “letter of release". IRD staff will normally take 30 to 40 minutes to generate the letter.

Conclusion

There are many documents that a business owner would need to file to the Inland Revenue Department so as to stay compliant to Hong Kong’s corporate governance rules. If you find that the paperwork is becoming a burden to you, let us help. We have professional company secretaries in Hong Kong that will help you take over, letting you focus on growing your company.