Is Setting Up a Private Limited Company in Hong Kong for Me?

Private limited companies (PLC) are the most popular type of business entity in Hong Kong: they make 99% of all businesses registered there.

But would a private limited company work for you? Let’s find out.

Tip

If you already know it does, check out our business registration service in Hong Kong.

What Is It? Brief Explanation

A private organization limited by shares is a legal entity that has the right to do business.

It can be called “HK Private Company Limited by Shares”, “a Limited Company” or just “Ltd.” — all that means a Private Limited Company.

The business owners possess shares. One shareholder can own 100% of the entity — or there can be several people. Each shareholder gets a proportion of the business’s profit in dividends.

What Are the Advantages of a Private Limited Company?

Your business’s financial obligations are not your obligations. A PLC is a legal entity separate from its owners. So if it messes up, the owners won’t have to give away their personal money to pay out the company’s debts.

In contrast, both a sole proprietor and a partner in a general partnership have to give away their personal assets if their businesses go under.

Jason’s company develops an app for Google Play. This app infects users with malware, and Google sues Jason’s business. The court rules that Jason must pay compensations to the affected users. The business entity can’t afford it and goes bankrupt but Jason doesn’t — he keeps his house, his car, and even his collection of butterflies. If Jason was a sole proprietor, all that would be sold to pay the compensations.

You company’s financial obligations affect shareholders to the amount of their shares. The investors will feel safe, because the only money they would risk losing is the amount they put in. Unlike in the case of a general partnership, for example.

Jason, Ann and Dan start together a PLC that does interior design. Each of them owns shares HK$1,000 worth. The business runs into debt of HK$30,000. “I told you not to trust that designer,'' says Jason. The company goes bankrupt, Jason, Ann and Dan lose HK$1,000 each. Had the guys set up a general partnership, Jason, Ann and Dan would have been legally obliged to pay the whole sum of the debt.

A foreigner or a foreign business entity can own 100% of an HK company. It works both when the Hong Kong business entity is independent and when it’s a foreign business’s subsidiary.

There are other business entity types to opt for when expanding for HK, but their opportunities are limited. Only a PLC can make unlimited profits, gain capital, and engage in activities other than the parent companies’.

Jason’s company decorates apartments in France. Jason wants to expand to HK and opens a PLC there. He finds investors and engages in another activity in Hong Kong — landscape design.

What Are the Drawbacks?

The setup procedure. You should apply both for a Certificate of Incorporation (saying you are registered with Company Registry) and a Business Registration Certificate (saying you are registered within Inland Revenue Department). You need to draw Articles of Association (details on the company). You need to meet the requirements for the directors, shareholders, employees — the details on that are below.

Maintenance. You need to comply with Hong Kong Companies Ordinance, outlining the requirements for a business’s operation. An officer called Company Secretary is in charge of that. If a your organization violates the Companies Ordinance, it can get fined or even closed.

Every year, you are to file an Annual Return with the Company Registry and an Annual Tax Return with the Inland Revenue Department.The first report contains up-to-date information on the business, its shareholders and top management. The second report includes your entity’s balance sheet, the report of an auditor and account of profits and losses.

Apart from these two major filings, a company is to renew the business registration and the business licence (if any), hold Annual General Meetings, keep the minutes of certain meetings, and hold a record of all the assets and liabilities. Ouсh.

Complicated striking off. You can either deregister or wind up the PLC. It may be deregistered only if didn’t start to operate. In this way, it’s relatively easy.

However, if you have been operating for some time, you will need to close the accounts, liquidate and distribute the assets, and pay all the debts and dividends. In this case, striking off can take up to several months.

Private Limited Company Registration in Hong Kong

So you’ve finally decided to set up your Private Limited Company in Hong Kong. What should you start with? Osome is by your side helping you understand the usual flow of setting up your organization.

Step 1: Choose your Company Name

Choosing a perfect name for your PLC is a vital step.

General Requirements state that:

- A company can have a name in English

- It can have a name in Chinese

- An English word or letter can’t be used together with Chinese characters in an organization name.

- If you choose an English business name, it must end with the word ‘Limited’.

- When you choose a Chinese business name, it must end with “有限公司”

You can find all the requirements in the Guideline on Registration of Company Names for Hong Kong Companies

Step 2: Allot Company Shares & Form Company Corporate Structure

Every incorporated business in Hong Kong, including a PLC, needs to have at least 1 or more registered shareholders. They may or may not be a resident in HK. A shareholder may be a person or a legal entity, liquidator, or sole proprietor.

Every Hong Kong private business limited by shares has certain structure to function properly and to comply with the law.

The issuing of new shares in a private limited incorporated company involves:

- The allotment of its shares to specific persons by PLC's directors.

- After the register of shareholders contains the relevant information about these people, shares are issued to these persons.

- The allotment of other shares requires the prior approval of shareholders in the general meeting.

- Shareholders may approve each allotment individually or in general. If not revoked earlier, the shareholder approval becomes valid at the next general meeting.

- One month after the allotment of shares, the Return of Allotment of Shares (Form NSC1) must be filed with the Registrar of Companies. This includes identifying members and their shares. Allotments may be made on one day or across a period of time (within one month).

Shareholders may form a management team and a board of directors with the following titles.

| The Management Team | A Board of Directors |

|

|

Step 3: Get your documents ready

When you meet all the mentioned requirements, it’s time to file the following documents, pay the fees and submit the documents to Companies Registry. You can do it via online registry, using a special “CR eFiling” mobile app, or in a hard copy form.

You will need:

- Incorporation Form - Form NNC1

- A copy of the company’s articles of association

- A Notice to Business Registration Office (IRBR1)

Step 4: Obtain your other Permits and Licenses

After one month, you must register your license or permit. Once you have registered them, they usually take 2-8 weeks to receive.

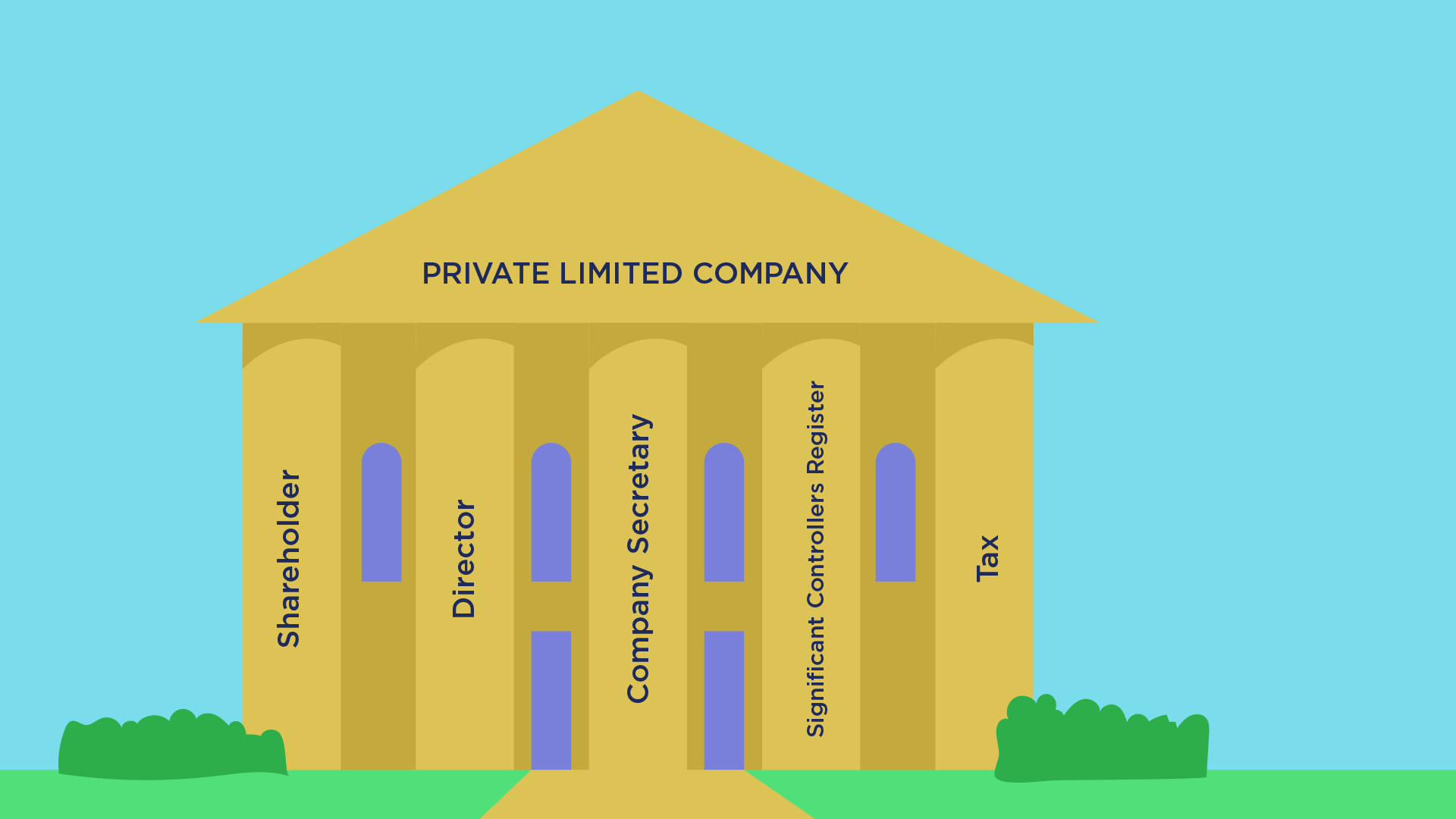

What a Private Limited Company Needs to Function

It needs at least 1 shareholder. Maximum is 50. Both individuals and companies can own shares. The minimum paid-up capital is HK$1. You can pick another currency and invest 1 euro, 1 yuan, etc. This means an organization can only issue 1 share worth HK$1 and it will work just fine.

It needs at least 1 director. No local director is needed, unlike, for example, in Singapore, Malaysia, or Indonesia. You, as the business owner, can be the only shareholder and the only director.

It needs a Company Secretary. This can be either a Hong-Kong based individual or a business organization with an office here and legal right to do this. The work of a corporate secretary is to maintain the business’s statutory books and records and ensure the compliance with all reporting requirements.

If you are the only director & shareholder, you can’t also be the company secretary — you will need someone else to fill the position.

It needs to keep an eye on the significant controllers register (SCR). The SCR is a list of people and companies that control the business (ultimate beneficial owners): those that hold more than 25% in shares, those that make changes to the board of directors, etc. For details, see the official guide.

It needs to pay tax. The Profits tax, to be more specific. It is counted through the two-tiered rate system introduced in 2018: under it, you pay 8.25% on assessable profits up to HK$2mln and 16.5% on any part of assessable profits over HK$2 mln.